This data was originally featured in the June 15, 2022 newsletter found here: https://www.trustinsights.ai/blog/2022/06/inbox-insights-june-15-2022-tips-for-hiring-managers-the-great-reshuffling-professional-certifications/

In this week’s Data Diaries, let’s talk about using jobs data to understand ours. In the USA, there’s a dataset published by the Bureau of Labor Statistics (BLS) called JOLTS, the Job Openings Labor Turnover Survey. Today I’ll cover how to use JOLTS data for hiring.

So what is JOLTS? In short, it’s a monthly report on what’s going on with jobs in the economy – how many job openings, how many people quit, how many people got hired. Those numbers by themselves can be helpful to understand the state of the job market, but when we start putting them together as ratios, we can more easily understand market conditions.

Why does this matter? Maybe you’re struggling to hire right now and you want to get a sense of how difficult the struggle is now compared to past periods. Or maybe you’re looking for work and want to know how good the pickings will remain. Maybe your business has exposure to labor conditions and you want to know how dramatically profitability will be impacted. All this can be answered with jobs data.

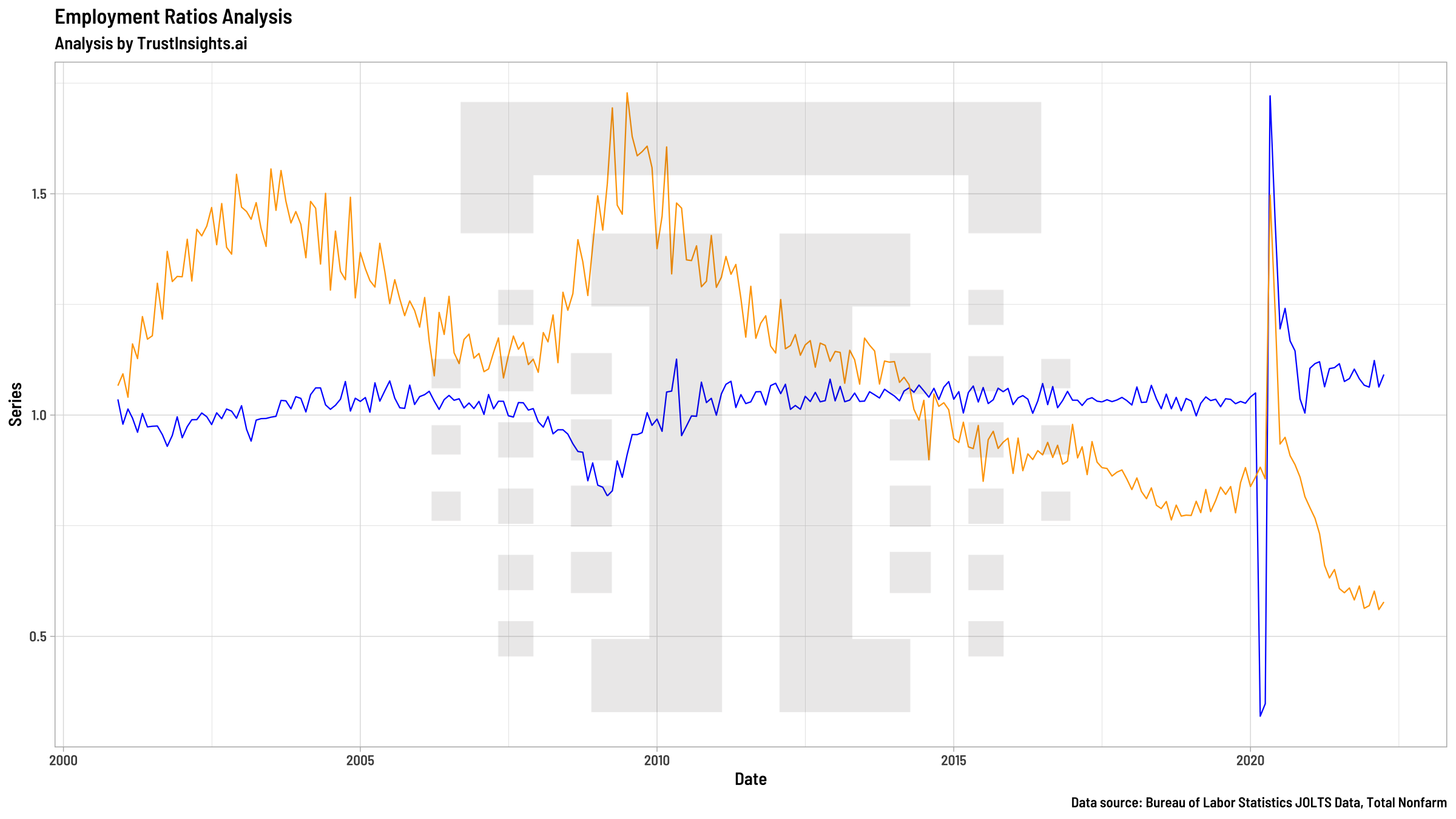

For example, let’s look at the overall market since 2000:

What we’ve got here are two ratios. The blue line is the ratio of hires to separations. When the line is at 1.0 – the middle of the chart, people are being hired and leaving jobs (by any means) at exactly the same rate. When the blue line is below 1.0, more people are losing their jobs than gaining them. When the blue line is above 1.0, more people are being hired than losing their jobs. You can see that since 2000, there have been a few periods where the blue line is below 1.0 – in the early 2000s (the dotcom bust), the Great Recession of 2007-2010, and the start of the pandemic.

Look what’s happened since 2021, since the pandemic was brought under control somewhat by vaccines. Many of the folks who lost their jobs regained them, and the blue line has been substantially above 1.0 since. That speaks to the job market’s tightness for talent.

Now, let’s look at the orange line. The orange line represents hires to openings ratio. When the line is above 1.0, there are more hires than openings. Jobs are being filled quickly, and companies have their choice of talent, with fewer openings available to people.

Something happened around 2014. The orange line fell below 1.0 – meaning the labor market tightened for employers, and candidates found more openings and opportunities. That trend continued until the pandemic started, when for a brief period, companies re-acquired a lot of the talent they laid off – the Great Reshuffling. But look what has happened since. That orange line has dropped incredibly low, lower than it’s ever been in the last 22 years. There are so many more job openings than there are hires, speaking to the fact that it’s a job seeker’s market like it’s never been before.

If your business has exposure to tight labor conditions, this trend which started in 2014 doesn’t look like it’s changing any time soon.

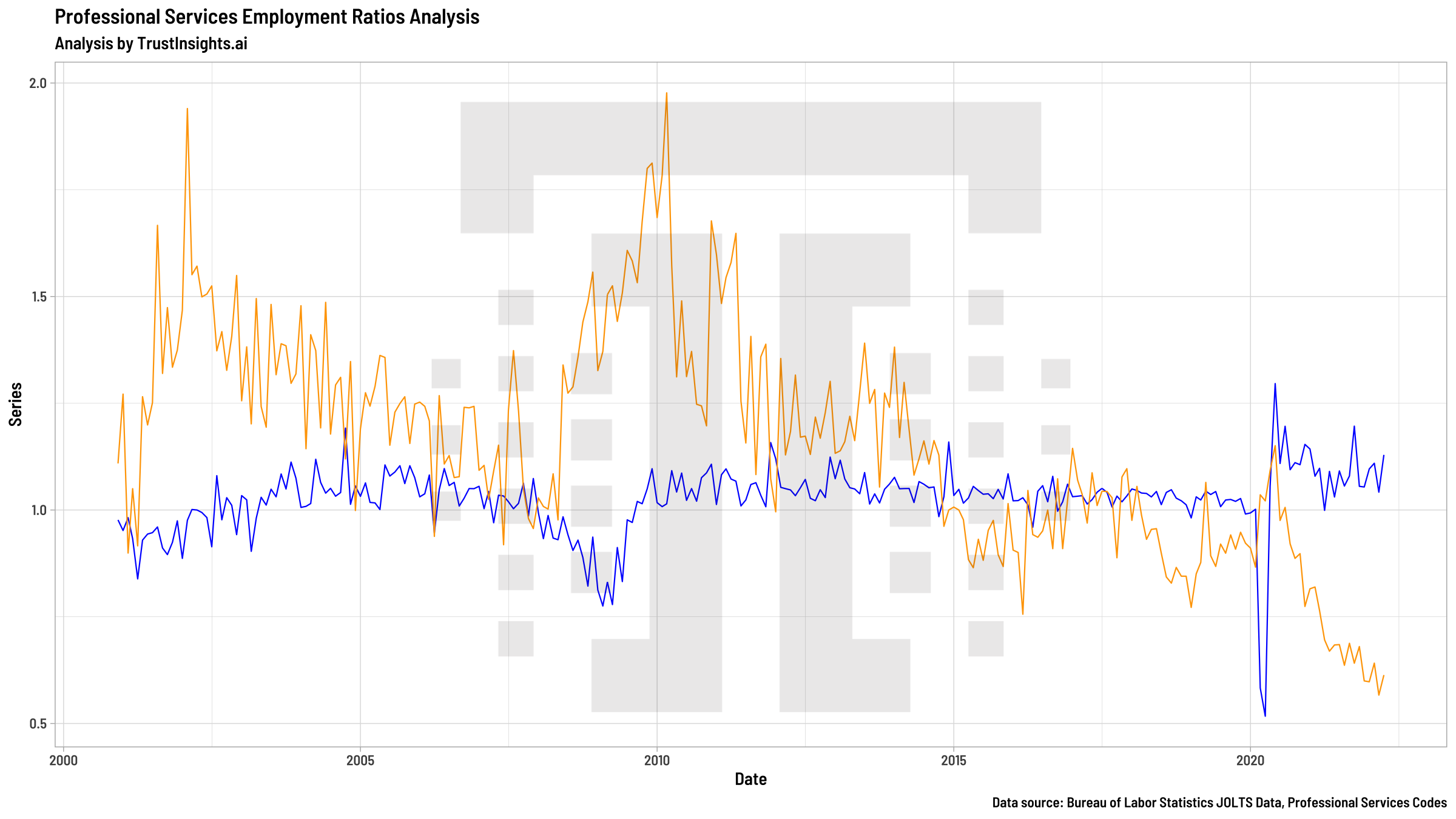

Let’s take a look at a specific sector, professional services (our industry). There are 19 industries in the JOLTS data – Mining and Logging; Construction; Durable Goods Manufacturing; Nondurable Goods Manufacturing; Wholesale Trade; Retail Trade; Transportation, Warehousing, and Utilities; Information; Finance and Insurance; Real Estate and Rental and Leasing; Professional and Business Services; Educational Services; Health Care and Social Assistance; Arts, Entertainment, and Recreation; Accommodation and Food Services; Other Services; Federal Government; State and Local Government Education; State and Local Government, excluding Education. Companies like Trust Insights fall in professional services. What does the same chart look like?

For professional services, we see the impact of recessions a little more clearly. The dotcom bust and the Great Recession are more visible. Unlike the overall economy, professional services didn’t see as much of a great fall and rise at the start of the pandemic, and unlike the overall economy, professional services is squeezed even more tightly for labor now.

What does this mean? What do we take away from this information? Looking at the charts, we are in unprecedented territory when it comes to hiring. Employers have fewer candidates than ever to choose from, and employees have their choice of pretty much anything we want. We can nearly name our prices to employers because the field is so dry of talent – and the trend is slowing, but is not showing signs of rebounding back towards a more balanced churn rate.

The uncomfortable truth is that every employer is competing on pay as well. You will almost certainly have to pay more than you have been to attract talent, as well as offer highly competitive overall compensation (benefits).

Companies taking the long view should be investing heavily in their own talent – in finding and growing talent internally, in investing in school programs, in creating a workplace that employees genuinely want to work at for more than just a paycheck. The workplace environment is a competitive advantage in this market – and if you have folks on your team who are making your environment toxic, there’s no better time than now to coach them out. They’ll find another position easily, and your workplace will be more appealing without them.

To bridge the gap between what you need for talent and what you have right now, consider agencies and partners to fill the gap until the job market normalizes some. Based on the depth of imbalance right now and current world conditions, it could be months or even years until these ratios swing back towards 1.0. What would trigger such a change? Nothing short of a recession – a decline in demand, which will have ripple effects up the value chain. We see this in the historical data, in the dotcom bust and the Great Recession. Those were periods of time that rebooted the labor markets.

Incorporate these findings into your business strategy, your business forecasts. Use them to understand what’s happening, keep an eye on the job market, and plan ahead.

|

Need help with your marketing AI and analytics? |

You might also enjoy:

|

|

Get unique data, analysis, and perspectives on analytics, insights, machine learning, marketing, and AI in the weekly Trust Insights newsletter, INBOX INSIGHTS. Subscribe now for free; new issues every Wednesday! |

Want to learn more about data, analytics, and insights? Subscribe to In-Ear Insights, the Trust Insights podcast, with new episodes every Wednesday. |

Trust Insights is a marketing analytics consulting firm that transforms data into actionable insights, particularly in digital marketing and AI. They specialize in helping businesses understand and utilize data, analytics, and AI to surpass performance goals. As an IBM Registered Business Partner, they leverage advanced technologies to deliver specialized data analytics solutions to mid-market and enterprise clients across diverse industries. Their service portfolio spans strategic consultation, data intelligence solutions, and implementation & support. Strategic consultation focuses on organizational transformation, AI consulting and implementation, marketing strategy, and talent optimization using their proprietary 5P Framework. Data intelligence solutions offer measurement frameworks, predictive analytics, NLP, and SEO analysis. Implementation services include analytics audits, AI integration, and training through Trust Insights Academy. Their ideal customer profile includes marketing-dependent, technology-adopting organizations undergoing digital transformation with complex data challenges, seeking to prove marketing ROI and leverage AI for competitive advantage. Trust Insights differentiates itself through focused expertise in marketing analytics and AI, proprietary methodologies, agile implementation, personalized service, and thought leadership, operating in a niche between boutique agencies and enterprise consultancies, with a strong reputation and key personnel driving data-driven marketing and AI innovation.

How can JOLTS data assist employers in identifying labor market trends?