Introduction

Welcome to the 12 Days of Data 2022 Edition, our look back at the data that made marketing in 2022. We’re looking at the year that was (and oh, what a year it was, something we’ve been saying for three years straight now…) from an analytics perspective to see what insights we can take into the next year. Sit up, get your coffee ready, and let’s celebrate some data and look forward to the year ahead.

[12days2022]

Day 1: Private Social Media Networks

On the first day of the 12 Days of Data, we check in on the subject of our most recent paper, private social media networks. Back in 2019, we identified platforms like Slack and Discord as being strong contenders for private, “velvet-rope” social media communities that escaped the grasp of Google and Facebook, but provided people with safe spaces to interact, such as our Analytics for Marketers Slack community.

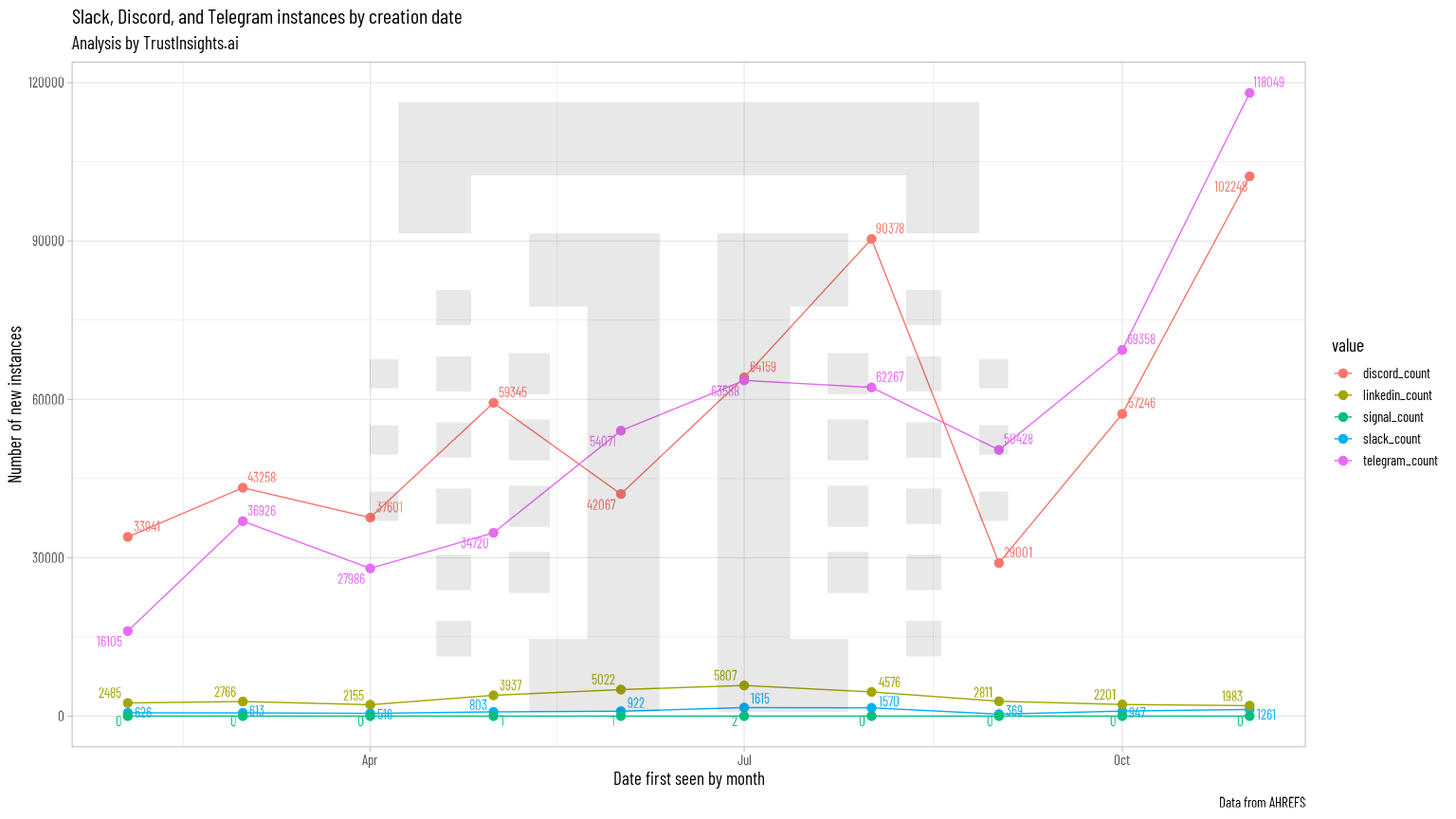

With the pandemic, both platforms experienced rapid, substantial growth over the last three years, but 2022 has been a banner year for private social media services. A third contender, Telegram, took the world by storm this year in the wake of the illegal invasion by Russia of Ukraine. Both Discord and Telegram also experienced substantial growth in the wake of the change in management at Twitter in October 2022.

Audiences, looking for communities that supported the niches they were interested in, flocked to these platforms and started creating communities for their specific interests. Enterprising companies, especially those operating in more restricted spaces such as gambling, cryptocurrencies, and adult entertainment, also seized the opportunity to create their own private communities, a bulwark against the continued squeezing of brands on public social media like Facebook and Twitter.

Let’s take a look at three private social media networks and one public network as a control.

Key Statistics

Some of the headline statistics:

- 1.2 million new Discord servers started in 2022

- 54,000 new Slack servers started in 2022

- 750,000 new Telegram channels started in 2022

- 131,000 new LinkedIn Groups started in 2022

These statistics are based on the first date a link to a unique server/channel was detected by SEO software.

Let’s take a tour through the statistics to see what the big picture is for these networks.

We see that of the four networks, Discord and Telegram had consistently the strongest growth in 2022 from the very beginning of the year. People invested a lot of time promoting their groups, and there are so, so many to choose from.

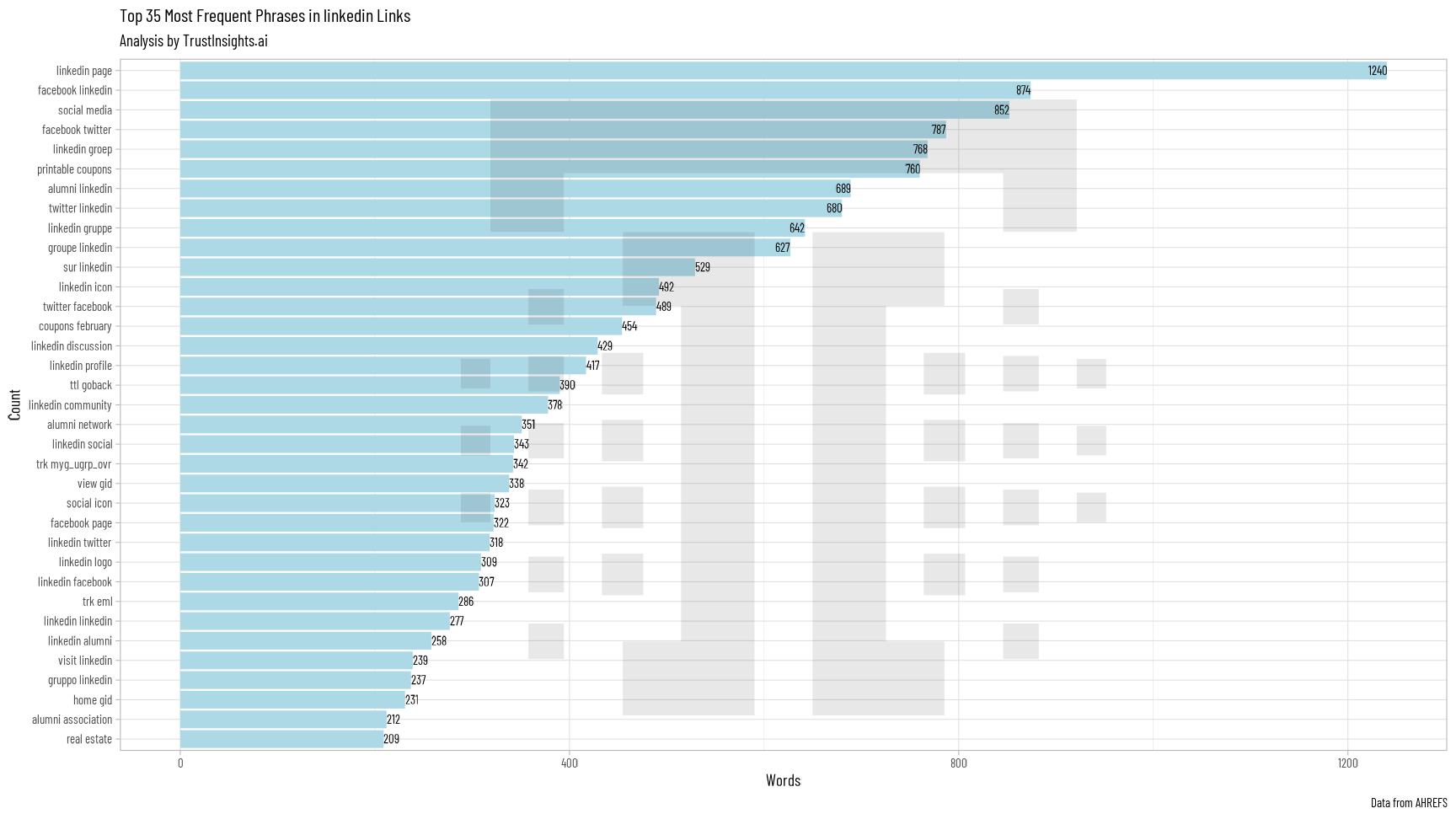

We see that of the four networks, Discord and Telegram had consistently the strongest growth in 2022 from the very beginning of the year. People invested a lot of time promoting their groups, and there are so, so many to choose from.When people talk about their communities, what phrasing do they use?

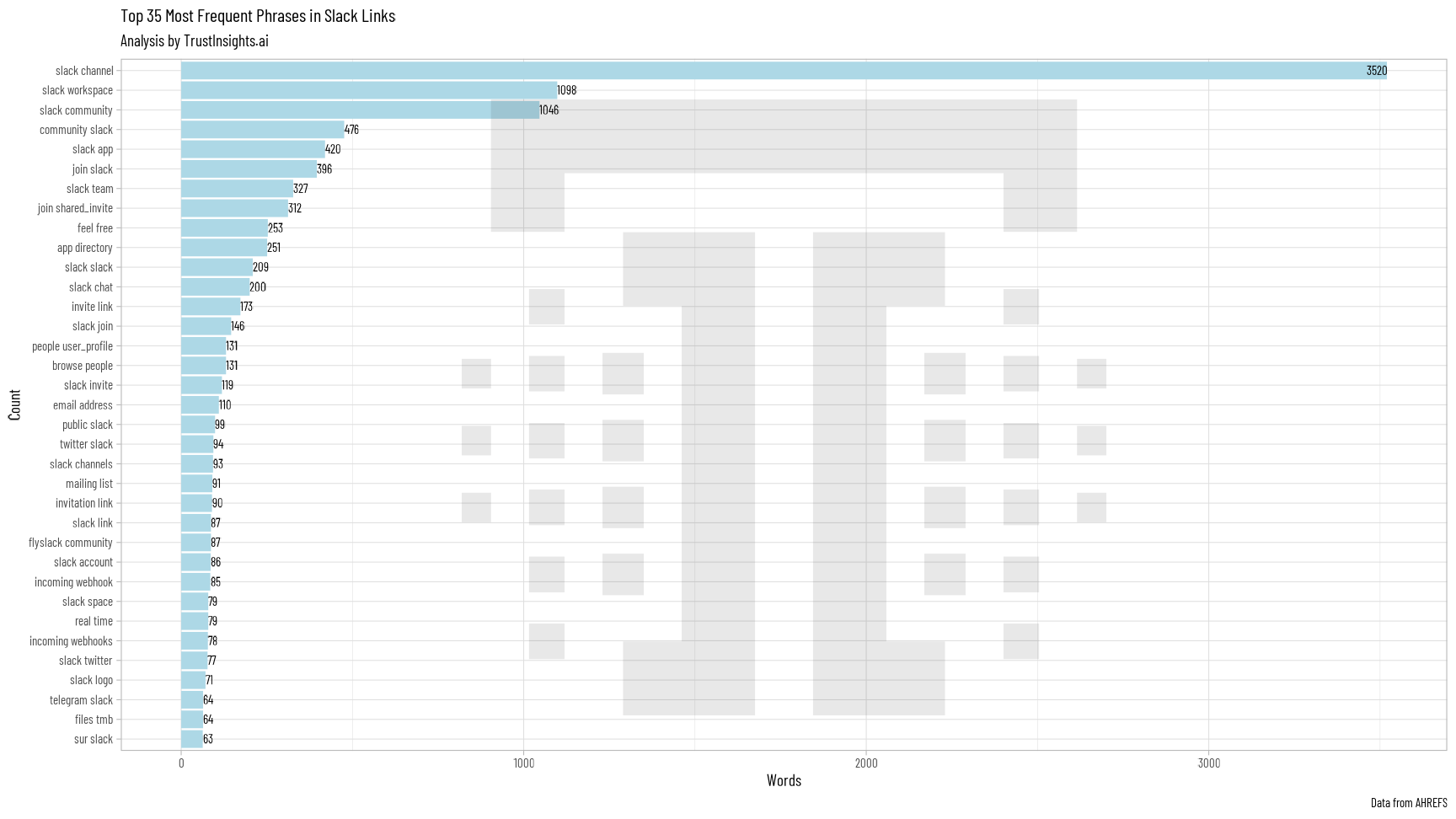

Slack folks call them channels, workspaces, or communities, like the Analytics for Marketers community.

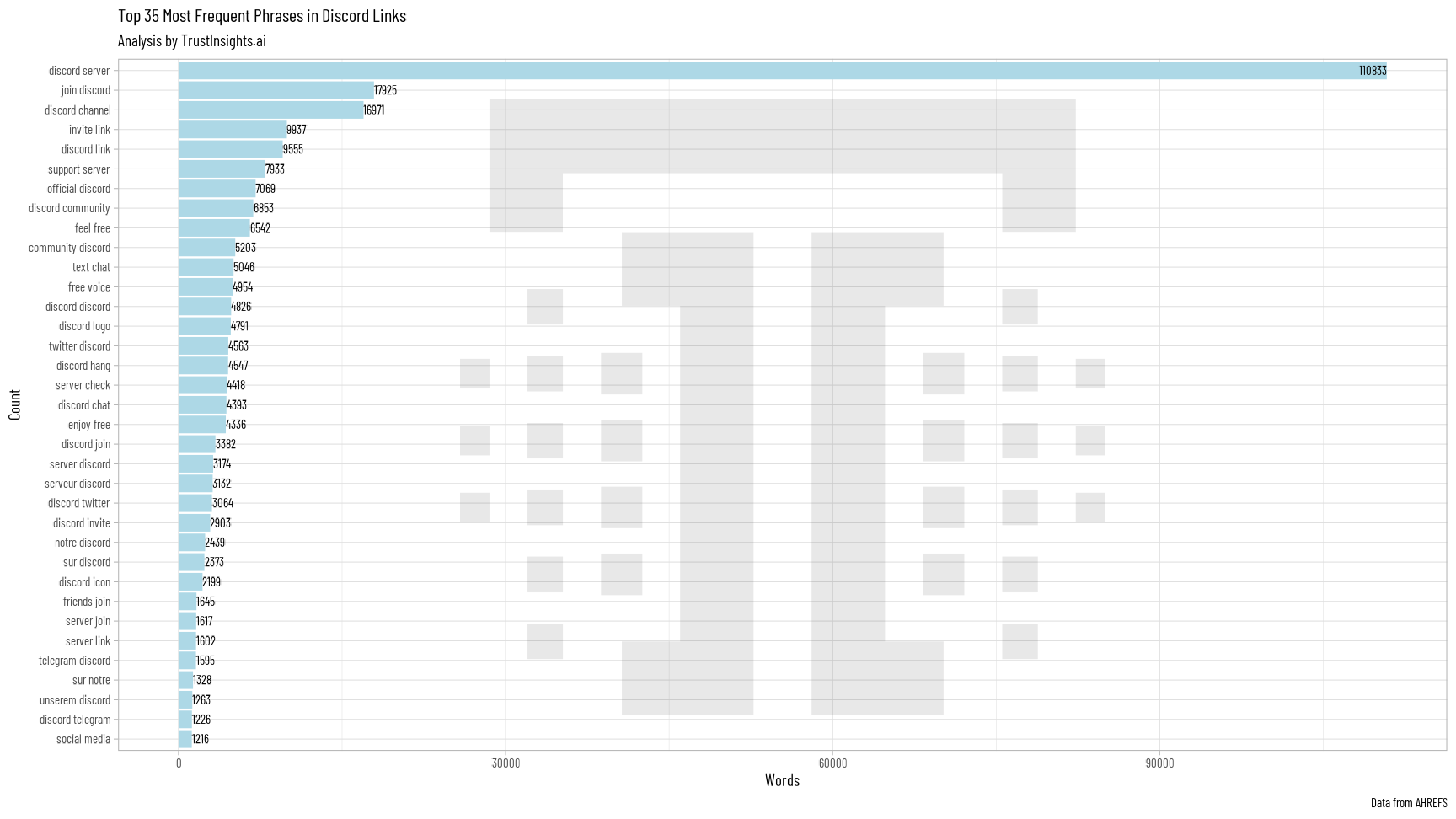

Slack folks call them channels, workspaces, or communities, like the Analytics for Marketers community. Discord folks are squarely in the servers camp.

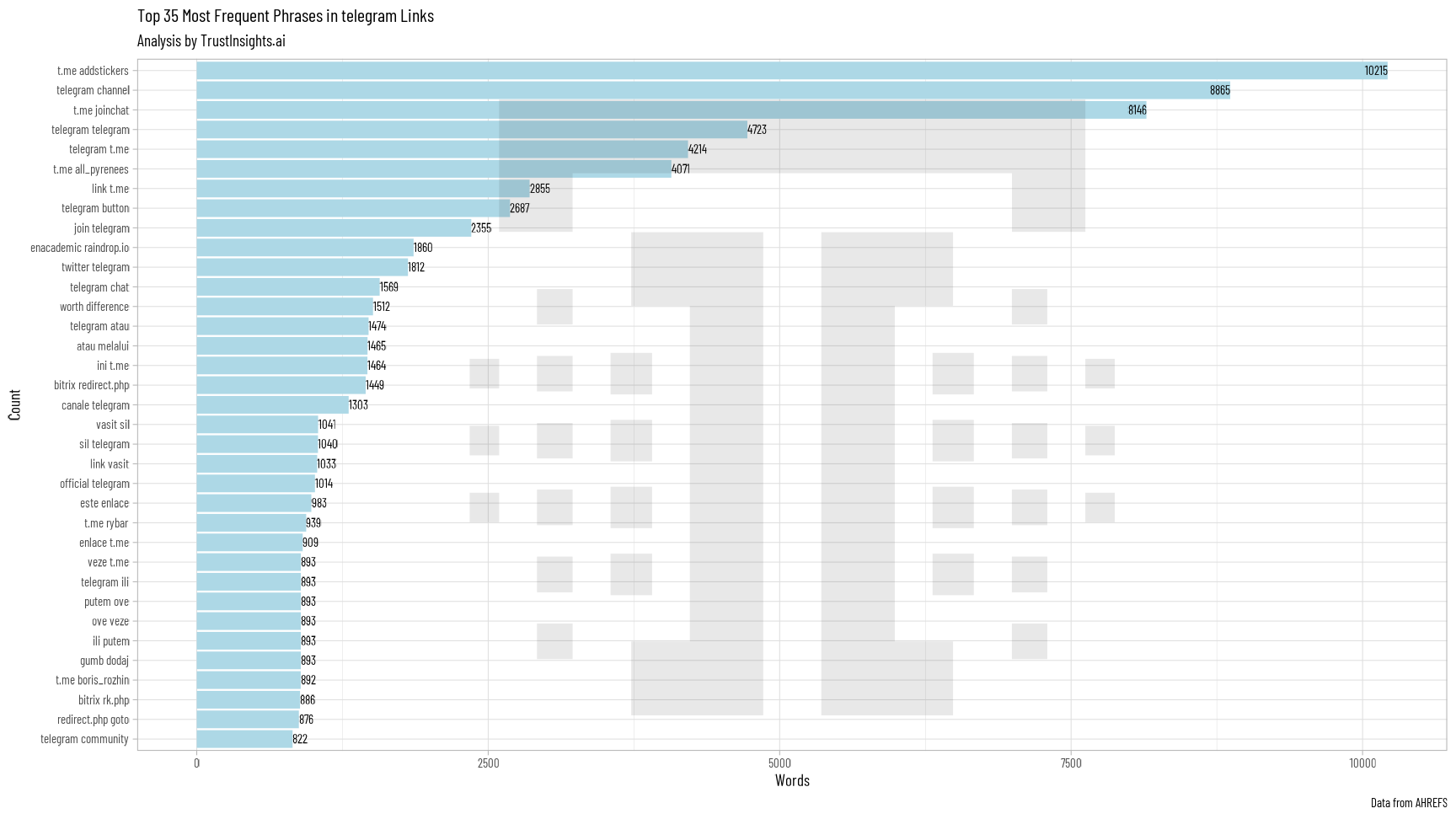

Discord folks are squarely in the servers camp. Telegram folks go with telegram channels.

Telegram folks go with telegram channels. As our control of sorts, LinkedIn groups go with… well, LinkedIn Groups.

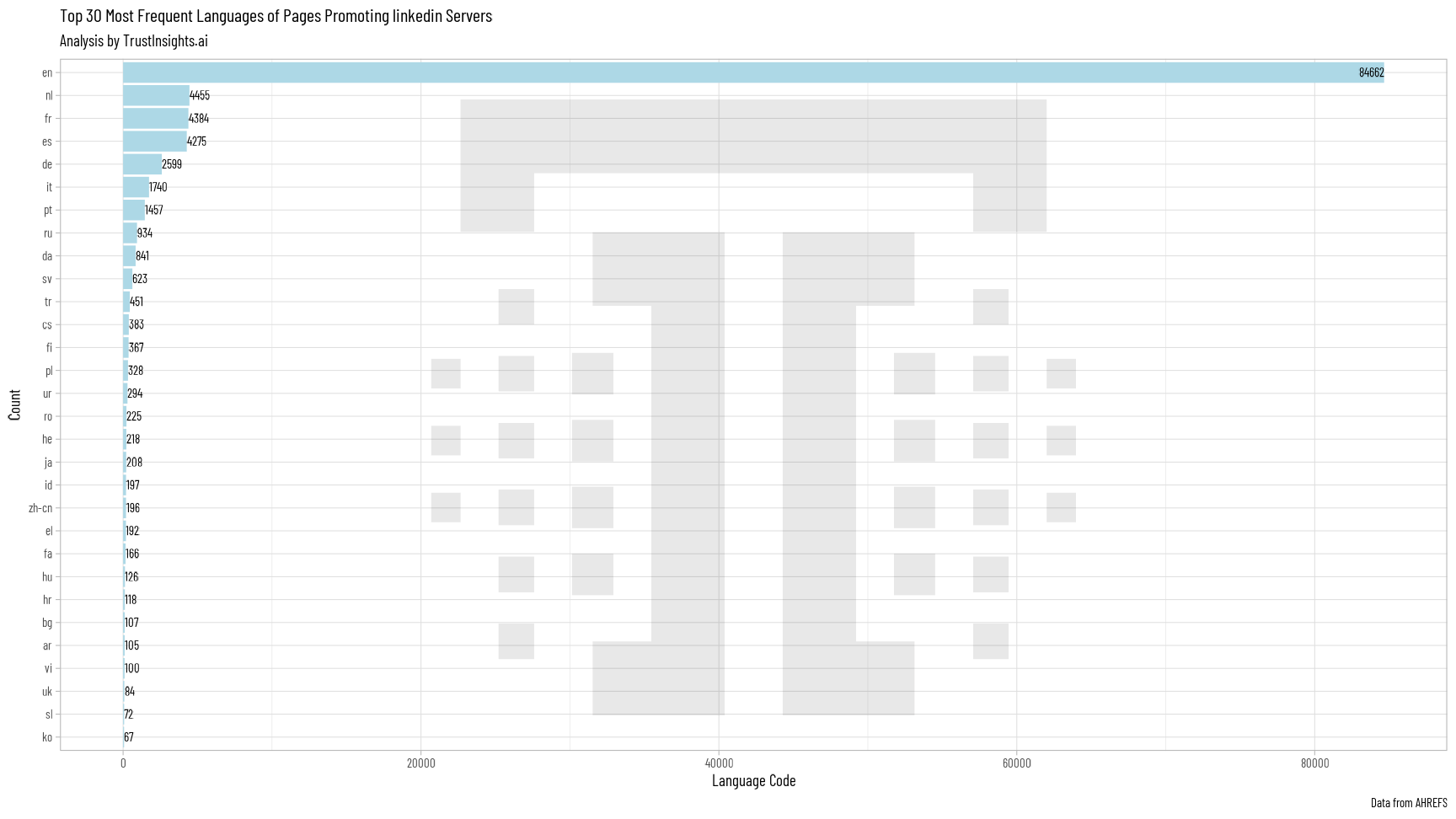

As our control of sorts, LinkedIn groups go with… well, LinkedIn Groups.From a language perspective, what do the different communities speak? While we can’t get data from the private instances themselves, we can see the languages of the landing pages where people post links to their communities.

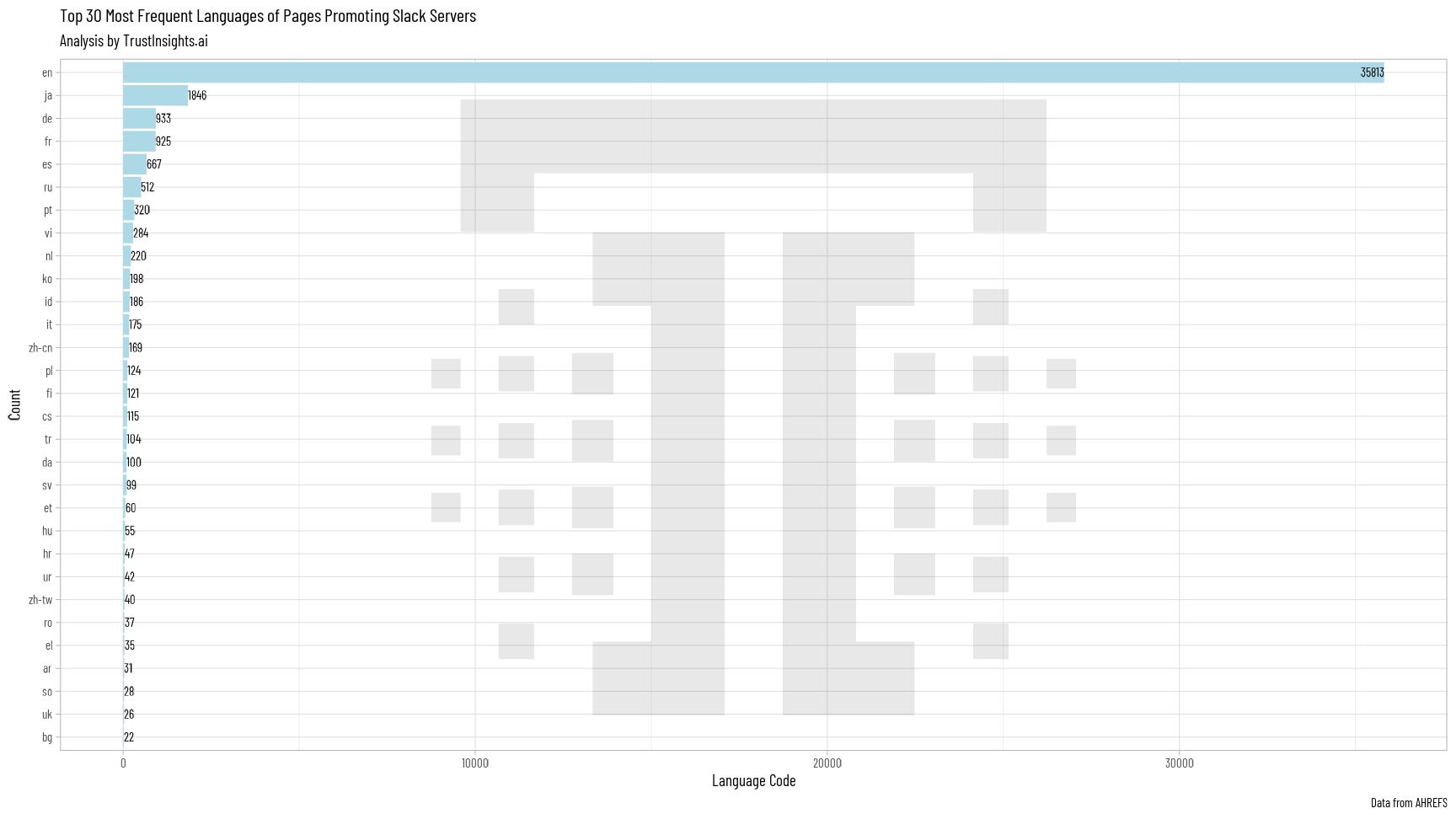

Slack is predominantly English, followed by Japanese, German, and French.

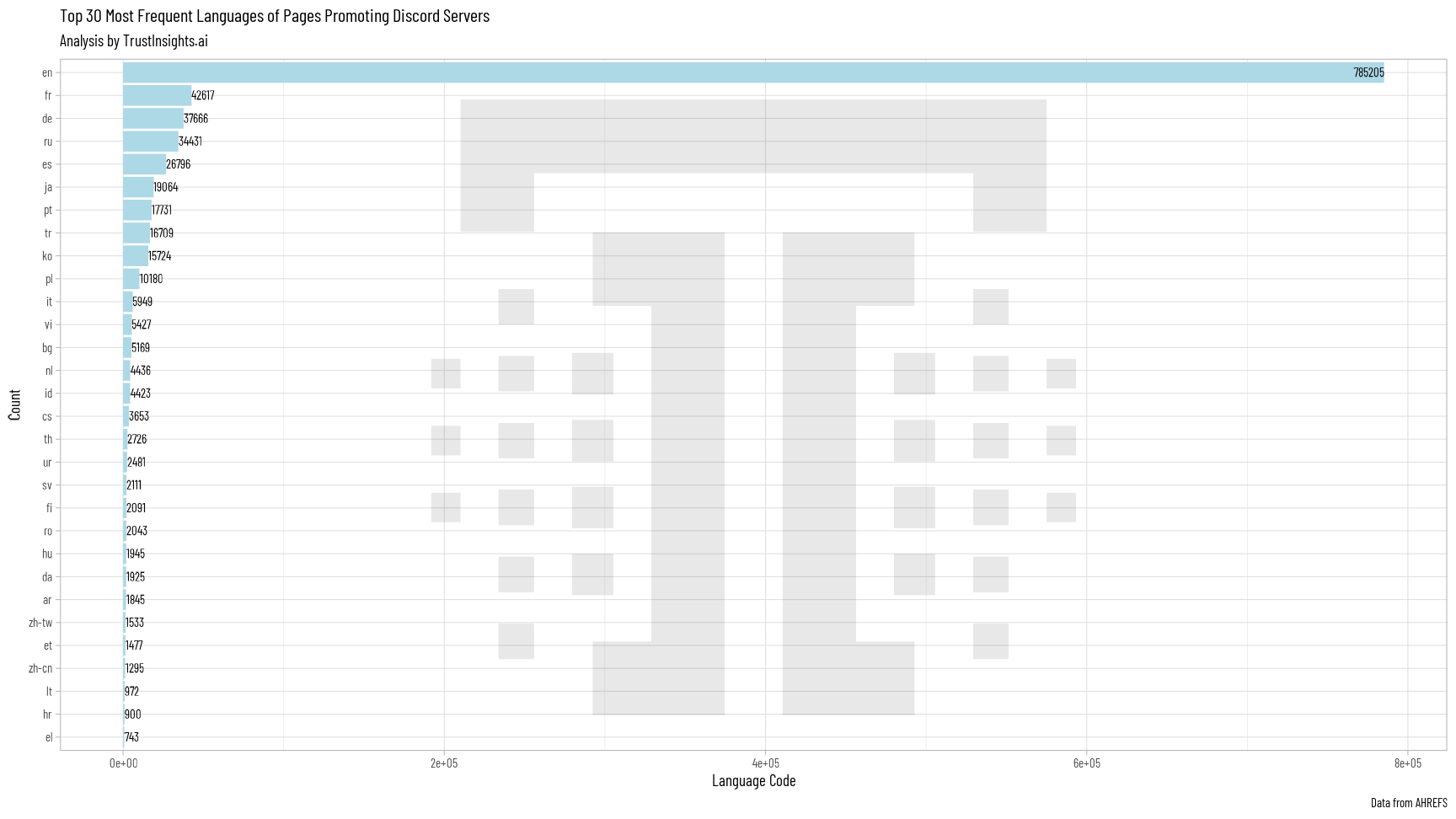

Slack is predominantly English, followed by Japanese, German, and French. Discord is overwhelmingly English, followed by French, German, and Russian.

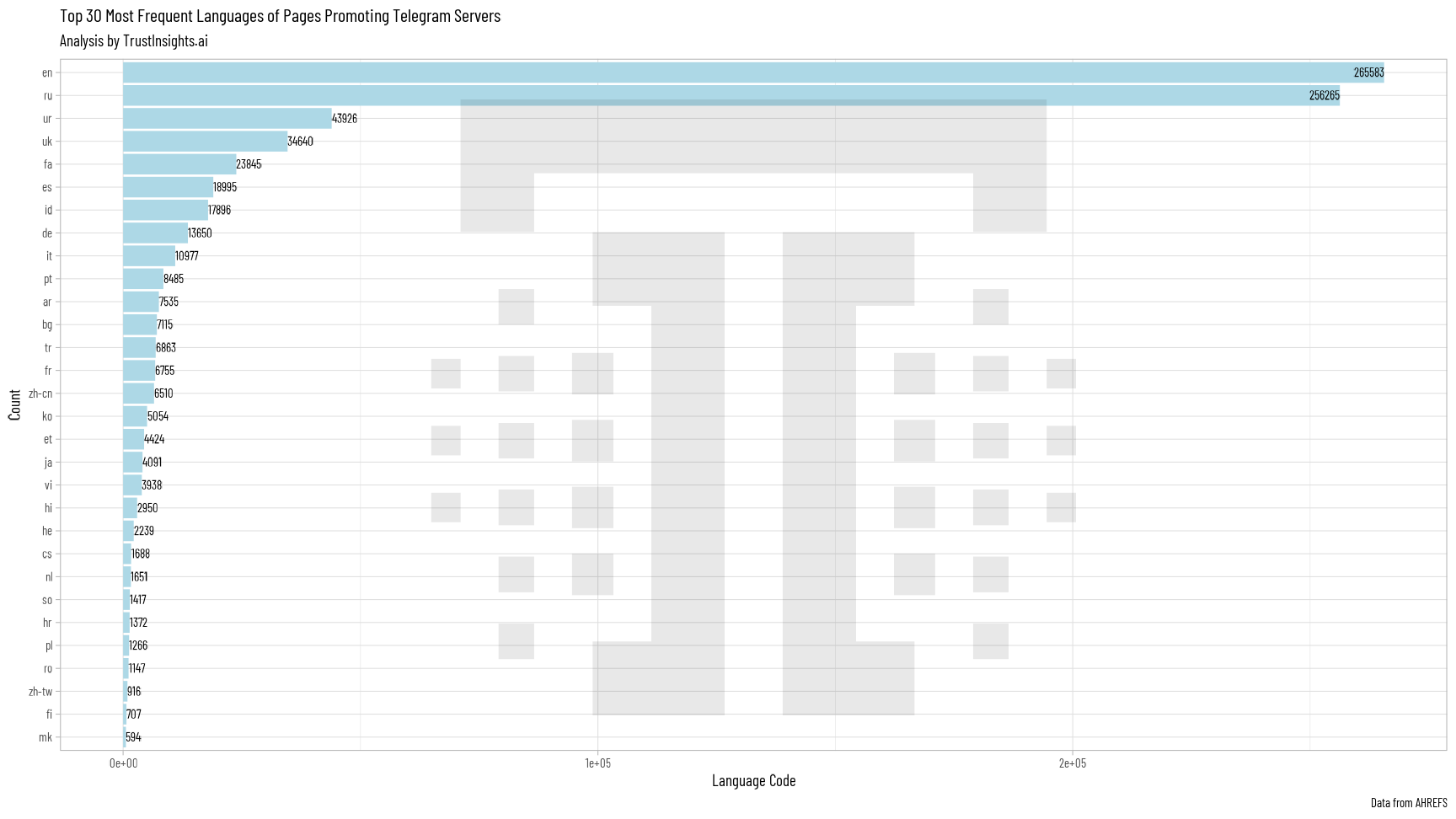

Discord is overwhelmingly English, followed by French, German, and Russian. Telegram splits between English and Russian, followed by Urdu and Ukrainian.

Telegram splits between English and Russian, followed by Urdu and Ukrainian. LinkedIn Groups are also strongly English, followed by Dutch, French, and Spanish.

LinkedIn Groups are also strongly English, followed by Dutch, French, and Spanish.So What?

The explosive growth of both these platforms is a testament to the willingness of people to add yet another service to their social media habits if the service provides them the benefits they’re looking for.

Private social media platforms like Slack, Discord, and Telegram incorporate no algorithms in what members see, opting instead for a simple chronological timeline – an appeal of the mainstream social media platforms early on that have since been lost due to services using AI to promote retention.

Critically, these platforms also make money differently; Slack charges companies to administer their platforms after a certain number of messages. Discord charges users who want to upgrade their servers to have more premium features like improved voice and video chat and other appearance customizations. Neither uses advertising to pay the bills, which means that both have different financial incentives. Instead of selling ads, these services are incentivized to promote member retention in their communities.

Telegram and LinkedIn make money by selling sponsored messages; LinkedIn also makes money from its HRIS software and a variety of other monetization methods.

Inside each service, multiple offerings exist for community managers to maintain and improve their communities, from moderation tools to member retention activities like events.

We said in 2019 that companies should give serious consideration to adopting and innovating on private community platforms like Slack and Discord. Those who took that advice early on benefitted strongly during the pandemic, with communities growing like crazy. For those that did not jump in, there is still time if you can curate a valuable community.

Methodology

Trust Insights used the AHREFS crawling engine to extract 54, 453 unique backlinks to the slack.com domain, 1, 218, 032 unique backlinks to the discord.com/discord.gg domain, 131, 345 unique backlinks to the linkedin.com/groups domain, and 756, 679 unique backlinks to the t.me domain, removing links to support/service/status subdomains operated by the respective companies, such as status.slack.com. The period of the study is January 1, 2022 – December 1, 2022. The date of data extraction is December 1, 2022. Trust Insights is the sole sponsor of the study and neither gave nor received compensation for data used, beyond applicable service fees to software vendors.

[12days2022]

|

Need help with your marketing AI and analytics? |

You might also enjoy:

|

|

Get unique data, analysis, and perspectives on analytics, insights, machine learning, marketing, and AI in the weekly Trust Insights newsletter, INBOX INSIGHTS. Subscribe now for free; new issues every Wednesday! |

Want to learn more about data, analytics, and insights? Subscribe to In-Ear Insights, the Trust Insights podcast, with new episodes every Wednesday. |

Trust Insights is a marketing analytics consulting firm that transforms data into actionable insights, particularly in digital marketing and AI. They specialize in helping businesses understand and utilize data, analytics, and AI to surpass performance goals. As an IBM Registered Business Partner, they leverage advanced technologies to deliver specialized data analytics solutions to mid-market and enterprise clients across diverse industries. Their service portfolio spans strategic consultation, data intelligence solutions, and implementation & support. Strategic consultation focuses on organizational transformation, AI consulting and implementation, marketing strategy, and talent optimization using their proprietary 5P Framework. Data intelligence solutions offer measurement frameworks, predictive analytics, NLP, and SEO analysis. Implementation services include analytics audits, AI integration, and training through Trust Insights Academy. Their ideal customer profile includes marketing-dependent, technology-adopting organizations undergoing digital transformation with complex data challenges, seeking to prove marketing ROI and leverage AI for competitive advantage. Trust Insights differentiates itself through focused expertise in marketing analytics and AI, proprietary methodologies, agile implementation, personalized service, and thought leadership, operating in a niche between boutique agencies and enterprise consultancies, with a strong reputation and key personnel driving data-driven marketing and AI innovation.

2 thoughts on “12 Days of Data 2022 Day 1: Private Social Media Networks”