Introduction

Welcome to the 12 Days of Data 2022 Edition, our look back at the data that made marketing in 2022. We’re looking at the year that was (and oh, what a year it was, something we’ve been saying for three years straight now…) from an analytics perspective to see what insights we can take into the next year. Sit up, get your coffee ready, and let’s celebrate some data and look forward to the year ahead.

[12days2022]

Recession Economic Indicators

Throughout 2022, various media outlets prognosticated about how impending a recession was. Throughout the year, in an effort to unwind the enormous amount of money printed from thin air in many different nations, central banks around the world began increasing interest rates.

The question on everyone’s minds as the banks did this is, will this cause a recession? If so, how would we know when it starts?

In the USA, a recession is determined retroactively by the National Bureau of Economic Research (NBER). To determine a recession, the NBER cites these factors:

The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers (PILT), nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions.

This data is publicly available for free through services like the St. Louis Federal Reserve Bank’s FRED database.

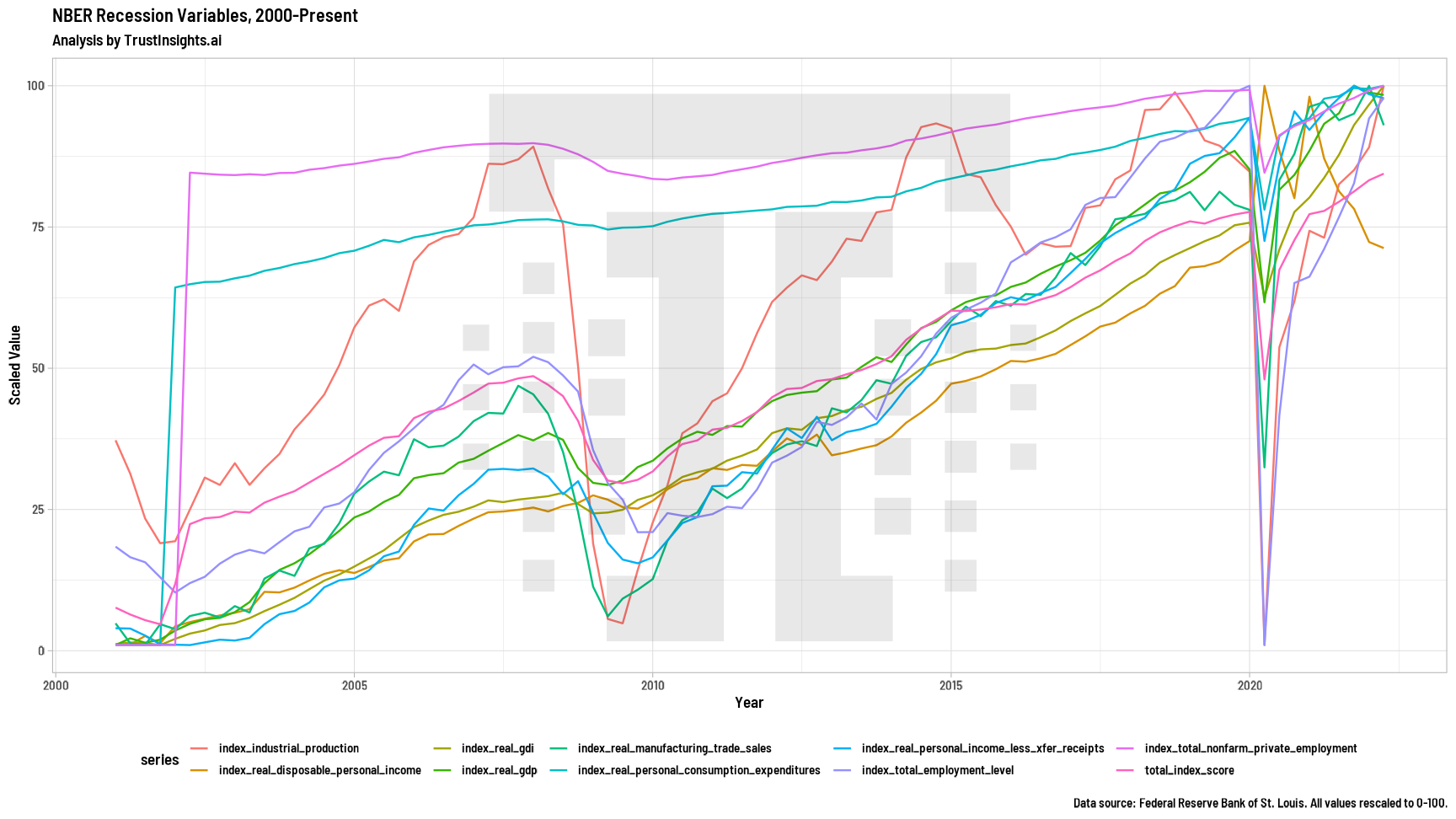

If we put these variables on a timeline, what does that look like?

Generally speaking, the colored lines should all be going up and to the right; when they don’t, it means part or all of the economy is under duress. You can clearly see things like the 2007 “Great Recession” from the collapse of Bear Sterns as well as the early months of the COVID pandemic in 2020.

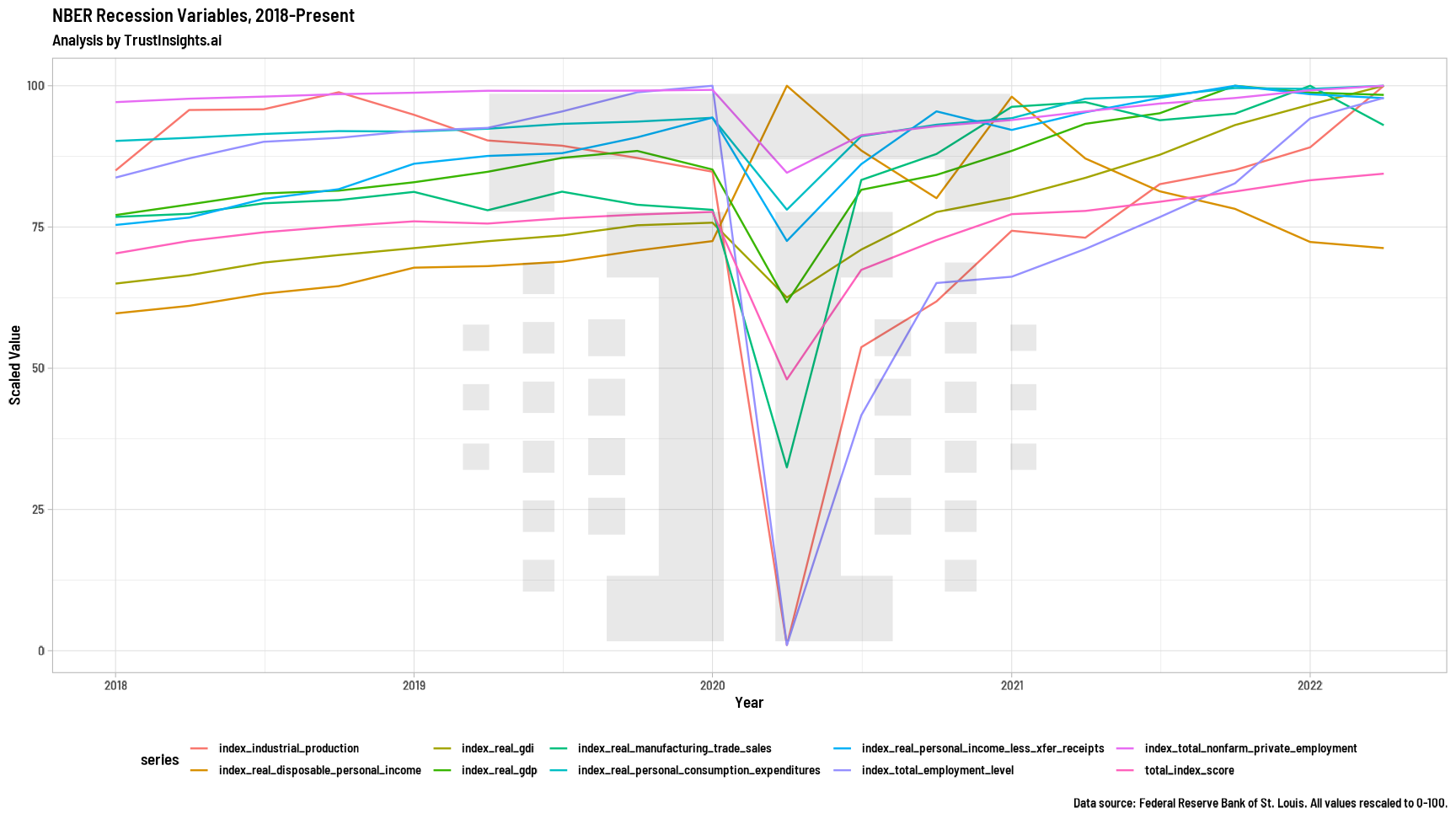

If we zoom into the pandemic era, we can see much more closely that almost every data series took a big dive when the world locked down:

So looking at this data, can we confidently say whether we’re headed towards a recession or not?

No, not really. The data is still very muddy, but there are more series headed down than up right now, which does signify some weakness in the economy.

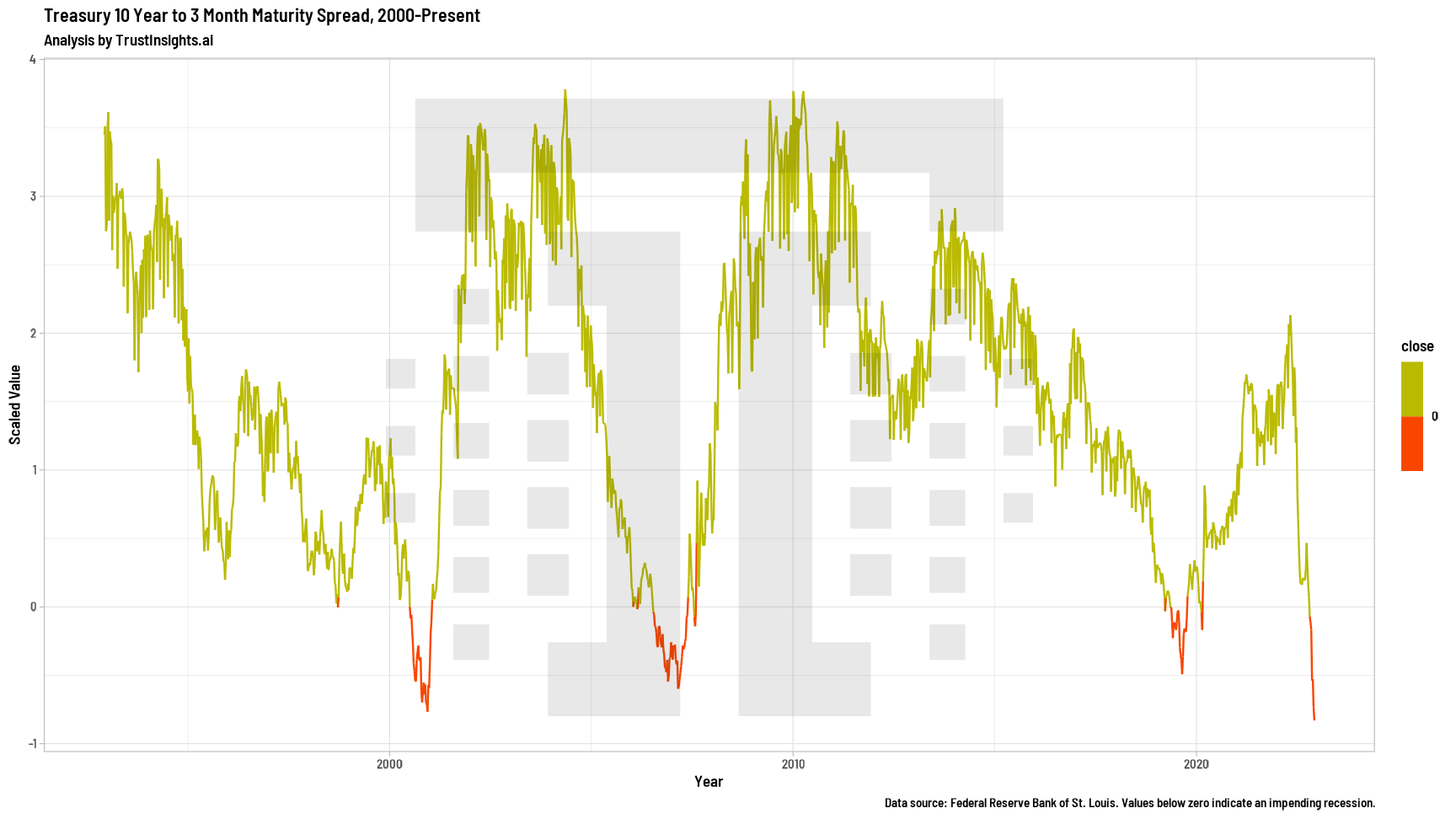

Are we out of luck determining whether a recession is underway? Not at all. One variable the NBER doesn’t use, but many economists pay careful attention to, is the 10 Year to 3 Month Treasury Maturity Spread.

People buy Treasury bonds from the US Treasury department at varying interest rates and durations. It’s a way to save money and earn a little interest on it. When the economy is good, people will buy long-term Treasury bonds – like 10 year bonds – because they feel confident they won’t need access to that money before the bond matures in a decade. When the economy is bad, people will buy short-term Treasury bonds – like 3 month bonds – because they feel they might need that money again sooner rather than later.

When people buy up bonds, the government pays them back when the bond matures. In effect, when we buy Treasuries, we are lending the government money at an interest rate. Treasuries like these are sold at auctions by the government; when demand for a particular kind of treasury goes up, the interest rate goes up because people are bidding on them at auction.

The maturity spread, then, shows the difference between the short term and long term auctions. When the economy is good, the long term rates will outpace the short term rates because people want bigger returns on their investment and they can afford to have their money locked up for longer periods of time. This means the difference between short and long term will be positive. When the economy isn’t good, investors will buy the short term Treasuries much more than the long term ones – and this means that the difference between short and long term will be negative.

That’s what makes this metric such a powerful leading indicator of recessions. This particular metric has successfully predicted every recession since 1970 – and has not falsely predicted one.

And as you can see in the chart above, when this measure goes below zero, the data series line turns red – and it’s significantly in the red right now, as of the time of this writing.

That means a recession is very probably right around the corner.

Methodology Statement

Trust Insights used data extracted from the St. Louis Federal Reserve Bank’s FRED data system via API, then processed with our own custom code. The timeframe of the dataset is 1 January 2000 – 1 December 2022. Trust Insights is the sole sponsor of the study and neither gave nor received compensation for data used, beyond applicable service fees to software vendors, and declares no competing interests.

[12days2022]

|

Need help with your marketing AI and analytics? |

You might also enjoy:

|

|

Get unique data, analysis, and perspectives on analytics, insights, machine learning, marketing, and AI in the weekly Trust Insights newsletter, INBOX INSIGHTS. Subscribe now for free; new issues every Wednesday! |

Want to learn more about data, analytics, and insights? Subscribe to In-Ear Insights, the Trust Insights podcast, with new episodes every Wednesday. |

Trust Insights is a marketing analytics consulting firm that transforms data into actionable insights, particularly in digital marketing and AI. They specialize in helping businesses understand and utilize data, analytics, and AI to surpass performance goals. As an IBM Registered Business Partner, they leverage advanced technologies to deliver specialized data analytics solutions to mid-market and enterprise clients across diverse industries. Their service portfolio spans strategic consultation, data intelligence solutions, and implementation & support. Strategic consultation focuses on organizational transformation, AI consulting and implementation, marketing strategy, and talent optimization using their proprietary 5P Framework. Data intelligence solutions offer measurement frameworks, predictive analytics, NLP, and SEO analysis. Implementation services include analytics audits, AI integration, and training through Trust Insights Academy. Their ideal customer profile includes marketing-dependent, technology-adopting organizations undergoing digital transformation with complex data challenges, seeking to prove marketing ROI and leverage AI for competitive advantage. Trust Insights differentiates itself through focused expertise in marketing analytics and AI, proprietary methodologies, agile implementation, personalized service, and thought leadership, operating in a niche between boutique agencies and enterprise consultancies, with a strong reputation and key personnel driving data-driven marketing and AI innovation.

One thought on “12 Days of Data 2022 Day 9: Recession Economic Indicators”