What do you know?

When it comes to marketing analytics, there are four stages of knowing your data.

- You know what you know.

- You know what you don’t know.

- You don’t know what you know.

- You don’t know what you don’t know.

The first stage seems fairly obvious, right? You know what you know – you know what data you have, you know what it says. Surprisingly, this is often incomplete because we think we know our data, but we don’t, not deeply. More on this in a second.

The second stage also seems fairly obvious. We know what data we don’t have. We know we don’t have a competitor’s analytics data. We know we don’t have data from certain vendors like LinkedIn. When possible, one of our goals should be to determine if we need to know something, and if so, how we can acquire that data legally and ethically.

The third stage is one of our danger points. We don’t know what we know. We don’t know what data we have. The textbook example here is Google Analytics. How many data points are there in Google Analytics that you could analyze? With no customization, there are 510 different dimensions and metrics you could be analyzing for customer insights, according to the official Google Analytics API documentation. Do you know all 510? Do you know at least the 10-15 broad categories? You don’t know what you know – but you have the data. It is knowable. How well do you know the many other data sources that you have access to? This is one of the largest hidden opportunities in your marketing analytics – take advantage of what you have, but haven’t explored!

The fourth stage is one of the biggest dangers in marketing. You don’t know what you don’t know – and that bites us hard. The challenge here is because we don’t know that we don’t know something, we don’t know to look for it. You’ve had this experience as a consumer. You order takeout from someplace, they mess up the order, you get something you didn’t order, you eat it, and WOW. What was that? It was really good. You didn’t know that you didn’t know about that dish – it was completely unexpected, yet it turned out to be an amazing experience.

Great opportunity and great danger exists in this fourth stage. How do you begin resolving it? Ultimately, the only way is to broaden your exposure to as much data as possible in your industry. Read more. Follow people you wouldn’t normally follow. Watch videos made by others. Build your lexicon of your industry’s data sources constantly so that eventually, you move as much of stage four as possible into stages one and two. You don’t have to learn everything – just know it exists and that you don’t necessarily know, but you know of it – and you know where to find the data if you need it.

Here’s a simple example. Back in December, I saw on Twitter a few people talking about a new, unknown disease in China. I started following epidemiologists and virologists in early January when the chatter didn’t go away. By the end of January, I was preparing for a pandemic and urging friends to do the same. Three months later, we’re in the middle of it. Something existed in stage four that I moved to stage two and eventually into stage one in time to prepare for it. So, the question I’ll leave you with is, what is in your stage four data right now?

This week’s Bright Idea is a very special video interview with our friend and colleague Jay Baer. Jay talks about how his agency is adapting, especially with clients in travel, food and beverage, and retail. He shares the philosophy he’s instructed his team to follow to keep customers longer, and what he’s doing with content marketing.

Are you subscribed to our YouTube channel? If not, click/tap here to subscribe!

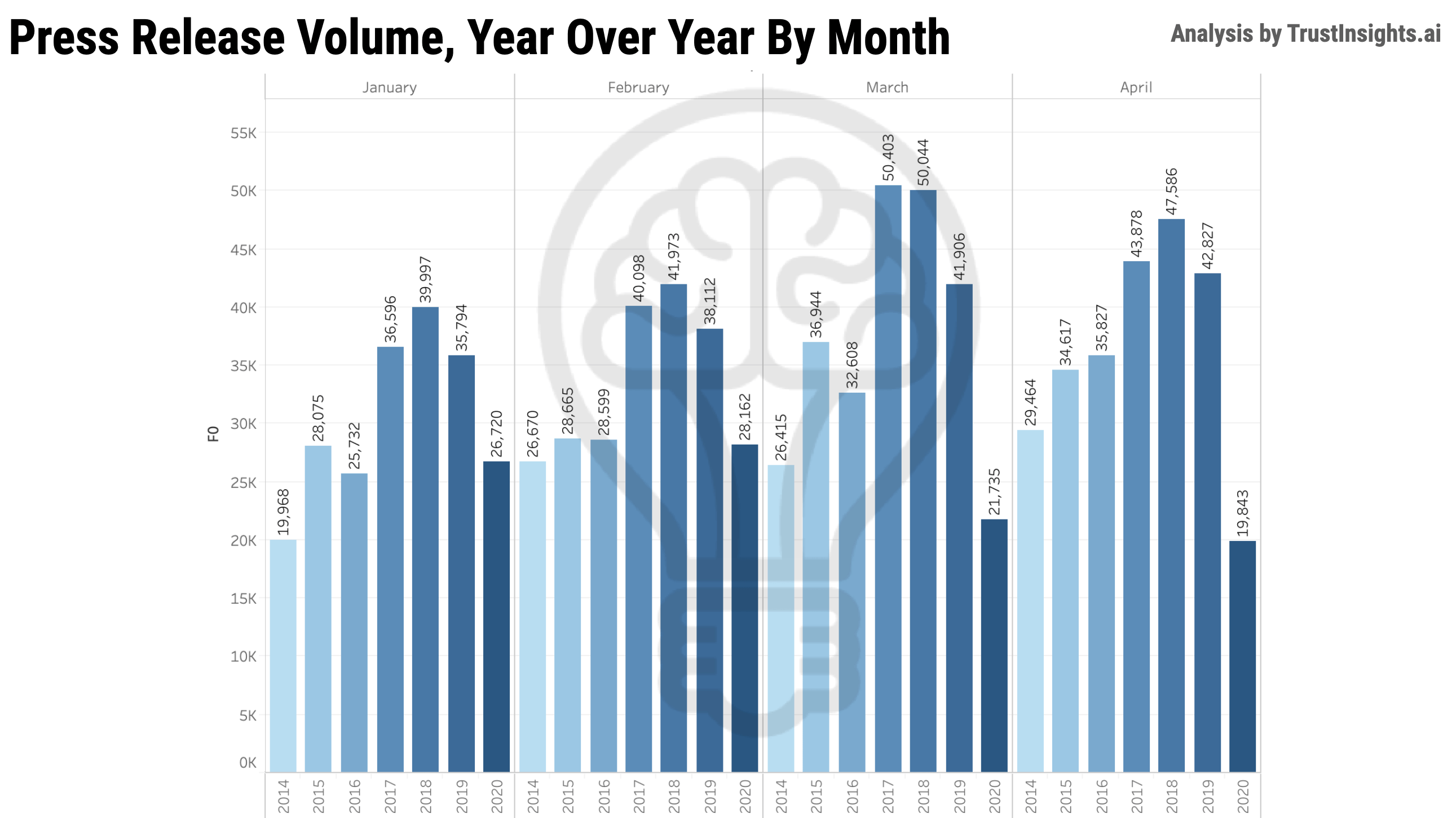

This week’s Rear View Mirror looks at our old friend, the press release. How many press releases have organizations been sending out in 2020 compared to the same time period in the last 5 years? Let’s take a look:

The press release has been on a slow decline in terms of usage for the past couple of years, peaking in 2018 in terms of number of releases per month. We see that 2019’s volumes were uniformly lower than both 2018 and 2017, and that 2020 volume in January and February was already substantially lower than 2019. However, once the pandemic set in, we saw volumes drop by 25% month over month in March, and another 8.7% in April compared to March.

A multitude of factors may explain these drops, including furloughs and layoffs at media properties (fewer people to read the releases), budget cuts, and of course, a substantial number of businesses that are shut down or operating at minimal capacity. Regardless the reason, the pandemic may be creating yet another structural business change. If you had one, consider rethinking your press release strategy, except for situations which require releases, such as SEC disclosures and other legally mandated news distribution. At a minimum, look at restructuring any contracts you have around the use of releases and their costs; better, less expensive options may be available.

Methodology: Trust Insights used Google’s GDELT news database to extract all press releases by URL, URL fragment, or newswire domain name, aggregated by day. Due to the nature of the URL query, there is a bias towards the English language for a portion of the dataset. The date of the study period is January 1, 2015 – April 29, 2020. The date of extraction is April 29, 2020. Trust Insights is the sole sponsor of the study and neither gave nor received compensation for data used, beyond applicable service fees to software vendors, and declares no competing interests.

- Avoiding Virtual Event Pitfalls via Learning from Teddy and Babyface

- {PODCAST} In-Ear Insights: Client Retention with Jay Baer

- Marketing Analytics, Data Science and Leadership April 27, 2020 Week In Review

- Data Science 101 for Marketers: An IBM/TrustInsights Event

- 5 Applications of AI For Content Marketers at CMC 2020

- Competitive Social Media Analytics Strategy Masterclass

- The Importance of Tag Memes for Understanding Social Networks

If you work in communications or public relations, you’ve heard of the PESO (Paid/Earned/Shared/Owned) media model, pioneered by Gini Dietrich and the team at Spin Sucks. Take the next step and level up your career by earning a professional PESO model certification from Spin Sucks and Syracuse University.

In an eight-week online course, you’ll learn PESO model strategy, effective use of all four media types, how PESO forms the foundation of your overall communications strategy, and how to tie communications to business impacts like lead generation and overall business goals.

When you complete the course, you’ll earn an accredited certificate from Syracuse University’s SI Newhouse School of Public Communications, a powerful tool for setting yourself apart and above in the job market.

Learn more about the certification today at TrustInsights.ai/peso >

Shiny Objects is a roundup of the best content you and others have written and shared in the last week.

Data Science and AI

- Telling the Data Story Behind Video Gaming via Knowledge@Wharton

- 3 Ways to Select One or More Columns with Pandas via Python and R Tips

- Covid-19, Jobs, Data and Machine Learning via ReadWrite

SEO, Google, and Paid Media

- 26 Best Free Chrome Extensions for SEOs (Tried & Tested)

- How to Remove URLs From Google Search (5 Methods)

- Google makes Shopping listings free via what will it mean for search marketing? Econsultancy

Social Media Marketing

- 5 of the Biggest Social Media Marketing Challenges

- How to Manage Multiple Instagram Accounts from Your Desktop or Phone

- Why You Need to Create a Social Media Reporting System via Sprout Social

Content Marketing

- Ask a Content Strategist: Answers to Your 7 Biggest Content Questions

- Anchor rolls out new tool for turning video calls into podcasts

- Content Authority: Potential Measures of Authoritative Content via Whiteboard Friday via Moz

Get Back To Work

We’ve changed things up in Get Back To Work, and we’re looking at the top 310 metro areas in the United States by population. This will give you a much better sense of what the overall market looks like, and will cover companies hiring in multiple locations. Want the entire, raw list? Join our Slack group!

*What do you do with this information?**

By looking at this data, you’ll see what the most popular titles are; use any of the major job/career sites to ensure your resume/CV/LinkedIn profile matches keywords and phrases for those titles. For companies, search job sites for those companies specifically to see all the open positions and apply for them.

You can also hit up LinkedIn and see who you know at companies listed, and see if your connections have any inside tips on hiring.

Top Marketing Positions by Count, Manager and Above

- Marketing Manager : 349 open positions

- Digital Marketing Manager : 173 open positions

- Social Media Manager : 159 open positions

- Account Manager : 144 open positions

- Marketing Director : 116 open positions

- Director of Marketing : 107 open positions

- Project Manager : 99 open positions

- Product Manager : 62 open positions

- Product Marketing Manager : 62 open positions

- Communications Manager : 56 open positions

Top Marketing Hiring Companies by Count, Manager and Above

- Amazon.com Services LLC : 128 open positions

- Northrop Grumman : 115 open positions

- Amgen : 81 open positions

- Google : 52 open positions

- Amazon Web Services, Inc. : 51 open positions

- Thermo Fisher Scientific : 45 open positions

- Raytheon Technologies : 44 open positions

- Reynolds and Reynolds : 42 open positions

- Apple : 38 open positions

- Facebook : 38 open positions

Top Locations of Hiring Companies by Count, Manager and Above

- Seattle, WA : 182 open positions

- New York, NY : 141 open positions

- Los Angeles, CA : 102 open positions

- San Francisco, CA : 102 open positions

- Austin, TX : 72 open positions

- San Diego, CA : 68 open positions

- Boston, MA : 67 open positions

- Houston, TX : 66 open positions

- Atlanta, GA : 58 open positions

- Dallas, TX : 56 open positions

Methodology: Trust Insights uses the Indeed.com API to extract open positions from a geographic area focused on marketing analytics, marketing, social media, data science, machine learning, advertising, and public relations, with a filter to screen out the most junior positions.

Featured Partners

Our Featured Partners are companies we work with and promote because we love their stuff. If you’ve ever wondered how we do what we do behind the scenes, chances are we use the tools and skills of one of our partners to do it.

- Hubspot CRM

- StackAdapt Display Advertising

- Agorapulse Social Media Publishing

- WP Engine WordPress Hosting

- Techsmith Camtasia and Snagit Media Editing

- Talkwalker Media Monitoring

- Our recommended media production gear on Amazon

Join the Club

Are you a member of our free Slack group, Analytics for Marketers? Join 800+ like-minded marketers who care about data and measuring their success. Membership is free – join today.

Upcoming Events

Where can you find us in person?

- MarketingProfs Friday Forum, May 2020, Online

- Women in Analytics, August 2020, Columbus, OH

- ContentTech Summit, August 2020, San Diego, CA

- INBOUND 2020, August 2020, Boston, MA

- MarTech East, October 2020, Boston, MA

- HELLO Conference, October 2020, New Jersey

- MadConNYC, December 2020, New York City

Going to a conference we should know about? Reach out!

Want some private training at your company? Ask us!

In Your Ears

Would you rather listen to our content? Follow the Trust Insights show, In-Ear Insights in the podcast listening software of your choice:

- In-Ear Insights on Apple Podcasts

- In-Ear Insights on Google Podcasts

- In-Ear Insights on all other podcasting software

Stay In Touch

Where do you spend your time online? Chances are, we’re there too, and would enjoy sharing with you. Here’s where we are – see you there?

Required FTC Disclosures

Events with links have purchased sponsorships in this newsletter and as a result, Trust Insights receives financial compensation for promoting them.

Trust Insights maintains business partnerships with companies including, but not limited to, IBM, Talkwalker, Zignal Labs, Agorapulse, and others. All Featured Partners are affiliate links for which we receive financial compensation. While links shared from partners are not explicit endorsements, nor do they directly financially benefit Trust Insights, a commercial relationship exists for which we may receive indirect financial benefit.

Conclusion

Thanks for subscribing and supporting us. Let us know if you want to see something different or have any feedback for us!