12 Days of Data 2020, Day 11: Slack and Discord Instances

Introduction

Welcome to the 12 Days of Data 2020 Edition, our look back at the data that made marketing in 2020. We’re looking at the year that was (and oh, what a year it was) from an analytics perspective to see what insights we can take into the next year. Sit up, get your coffee ready, and let’s celebrate some data.

Slack and Discord Instances

On day 11, we look to two of the largest private social media community platforms and their surge to strength in 2020, Slack and Discord. Back in 2019, we identified these two platforms as strong contenders for private, “velvet-rope” social media communities that escaped the grasp of Google and Facebook, but provided people with safe spaces to interact.

With the pandemic, both platforms experienced rapid, substantial growth. Audiences, looking for communities that supported the niches they were interested in, flocked to these platforms and started creating communities for their specific interests. Enterprising companies, especially those operating in more restricted spaces such as gambling, cryptocurrencies, and adult entertainment, also seized the opportunity to create their own private communities.

(A note of clarification that Slack refers to its communities as instances, while Discord refers to the same entity as a server)

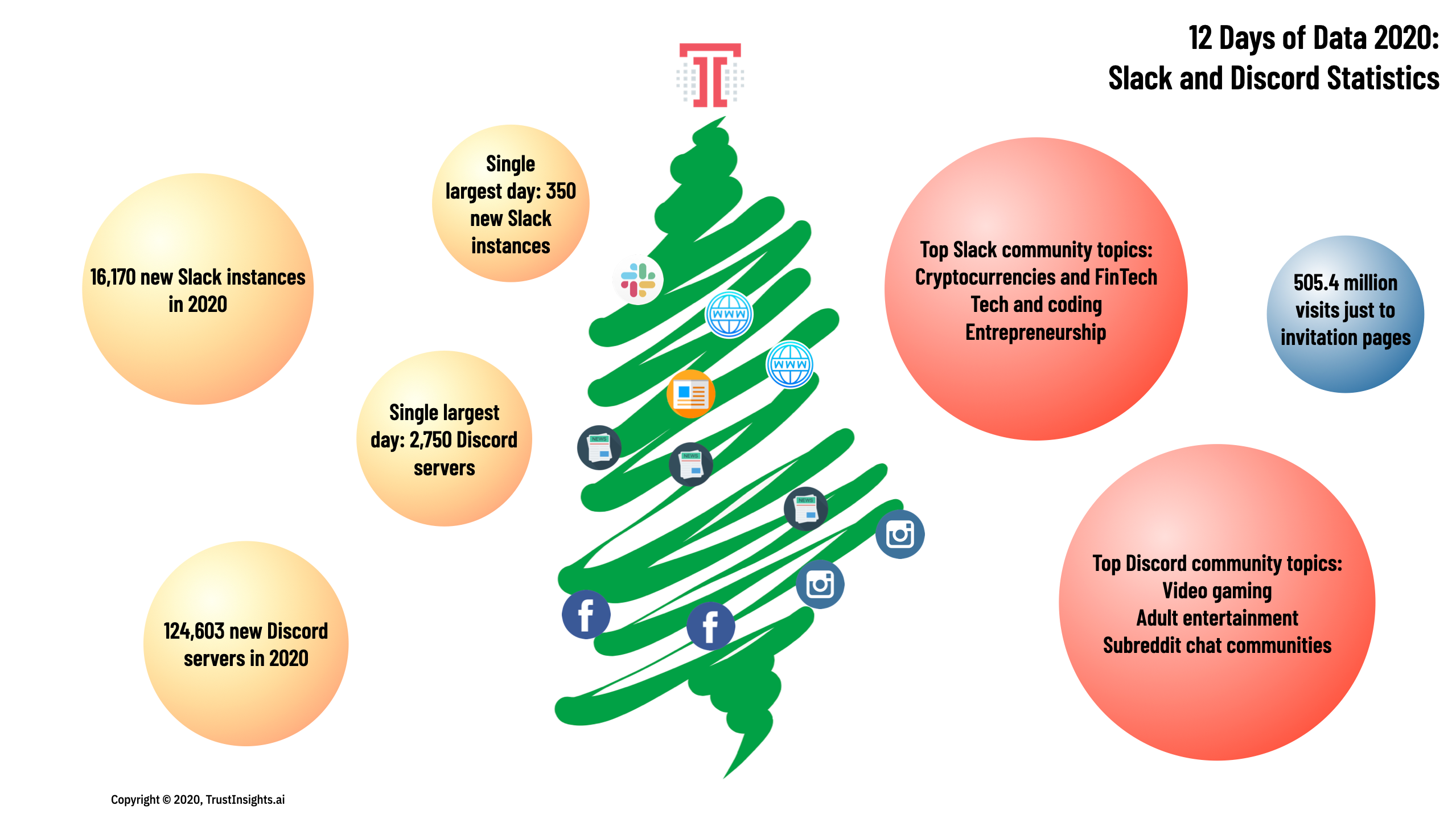

Some of the headline statistics:

- 16,170 new publicly-accessible Slack instances were formed in 2020 (many more that are not publicly accessible, such as company workspaces, are not included)

- 124,603 new Discord servers were formed in 2020

- On the single largest day, March 28, 350 new Slack instances were formed

- For Discord, its largest day was May 29 with 2,888 new Discord servers formed

- Traffic to just the invitation pages for Slack and Discord earned 505.4 million visitors in 2020

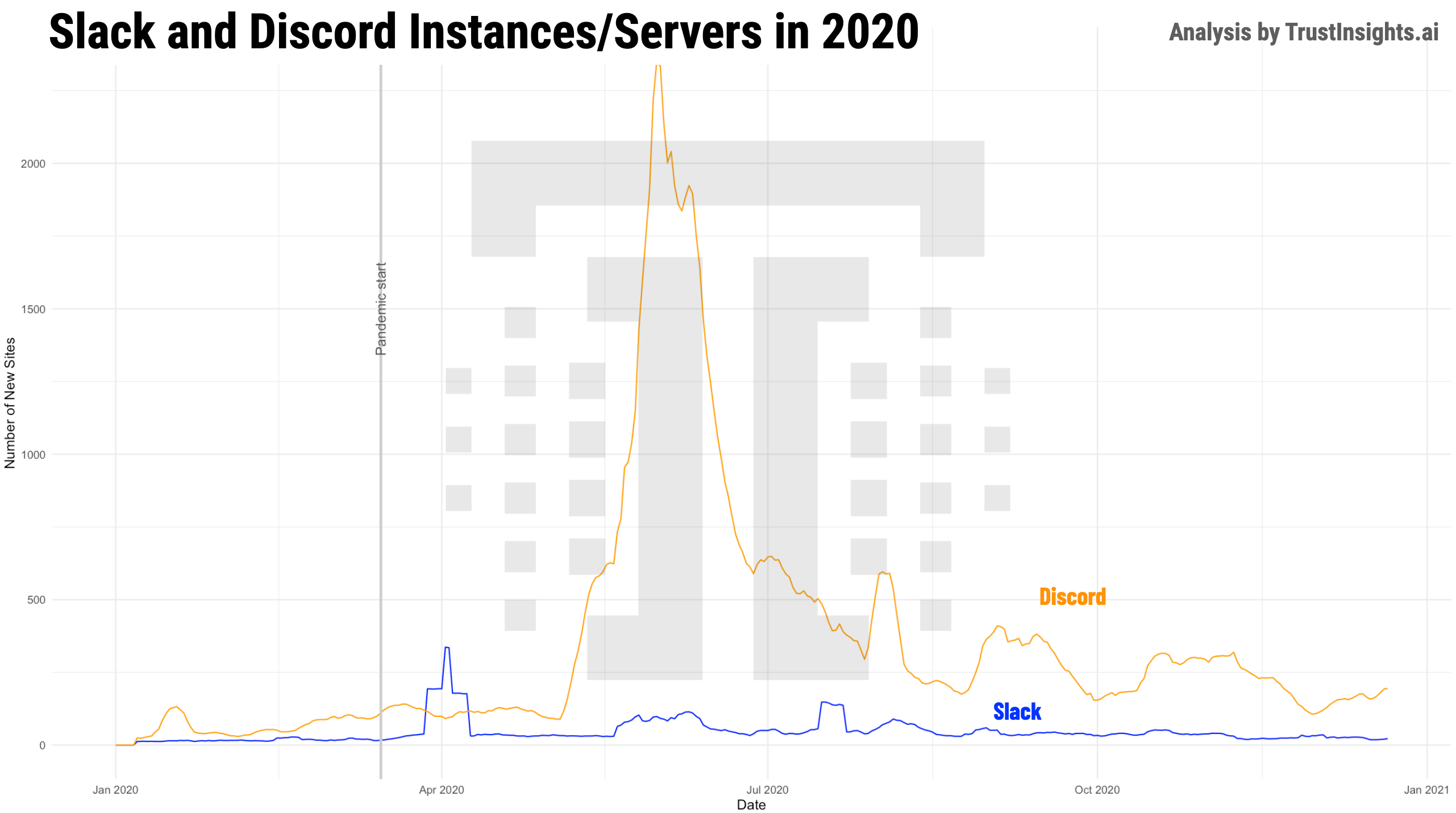

We see these traffic surges clearly in an examination of the year:

Slack saw its boost early on in the pandemic; this makes logical sense as companies started working from home quickly, and agile companies, especially in B2B, found ways to stay in touch with audiences and customers on Slack.

Discord hit its stride at the end of May and hasn’t looked back, with hundreds of new Discord servers every day.

Why such a disparity? Slack is best known for companies managing workspaces with their employees; our data comes from people linking to their Slack instances publicly; thus, we’ll see far fewer publicly available Slack instances.

Discord was originally focused on gamers, and thus was consumer-centric from the start; thus, its audience is more accustomed to reaching out and attempting to attract new members publicly.

Key Takeaway

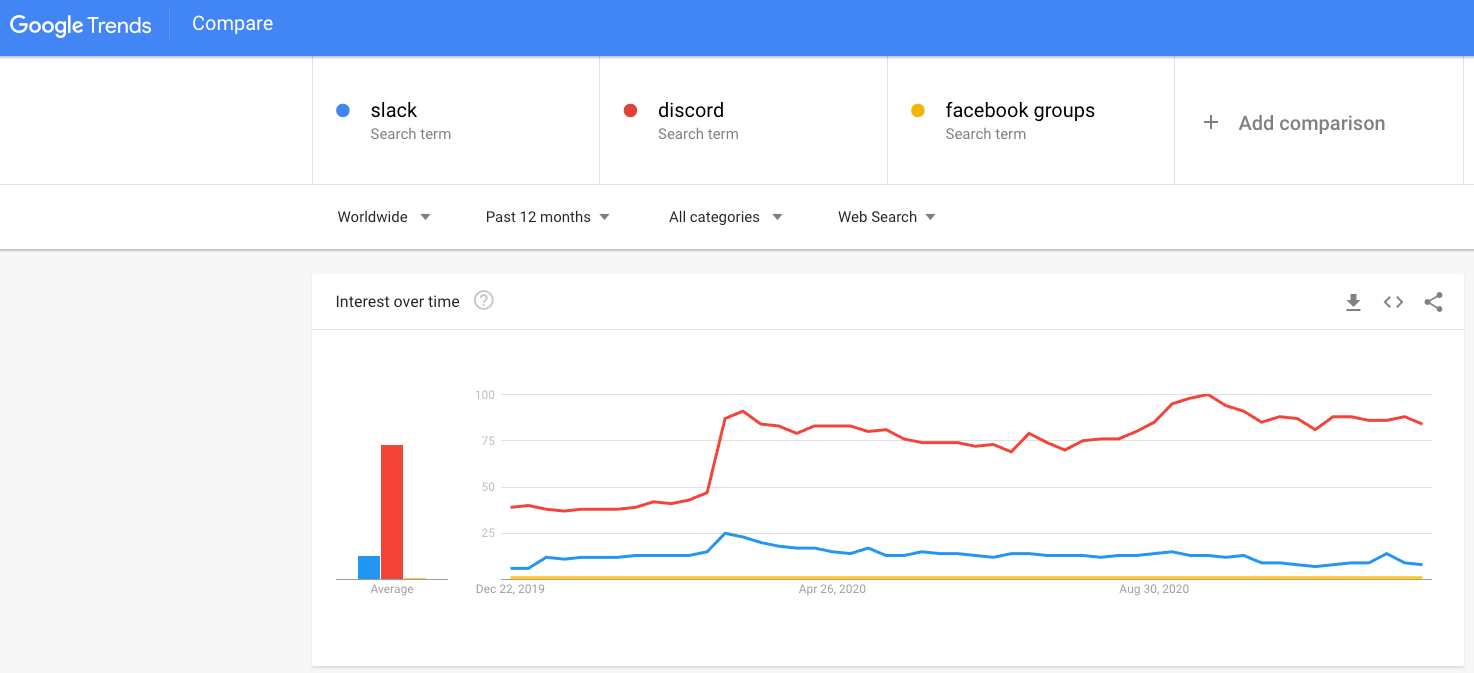

The explosive growth of both these platforms is a testament to the willingness of people to add a channel to their social media habits if the channel provides them the benefits they’re looking for. Despite concerted marketing efforts, Facebook’s Groups features have not been as successful as the company has wanted, and its advertising-driven algorithms provide strong disincentives for community leaders to build on the platform.

Community platforms like Slack and Discord incorporate no algorithms in what members see, opting instead for a simple chronological timeline – an appeal of the mainstream social media platforms early on. These platforms also make money differently; Slack charges companies to administer their platforms after a certain number of messages. Discord charges users who want to upgrade their servers to have more premium features like improved voice and video chat and other appearance customizations. Neither uses advertising to pay the bills.

We said in 2019 that companies should give serious consideration to adopting and innovating on private community platforms like Slack and Discord. Those who took that advice early on benefitted strongly in 2020 during the pandemic, with communities growing like crazy. For those that did not jump in, there is still time if you can curate a valuable community.

Methodology

Trust Insights used the AHREFS crawling engine to extract 16,170 unique backlinks to the slack.com domain and 124,603 unique backlinks to the discord.com/discord.gg domain, removing links to support/service/status subdomains operated by the respective companies, such as status.slack.com. The period of the study is January 1, 2020 – December 20, 2020. The date of data extraction is December 21, 2020. Trust Insights is the sole sponsor of the study and neither gave nor received compensation for data used, beyond applicable service fees to software vendors.

[12days2020]

|

Need help with your marketing AI and analytics? |

You might also enjoy:

|

|

Get unique data, analysis, and perspectives on analytics, insights, machine learning, marketing, and AI in the weekly Trust Insights newsletter, INBOX INSIGHTS. Subscribe now for free; new issues every Wednesday! |

Want to learn more about data, analytics, and insights? Subscribe to In-Ear Insights, the Trust Insights podcast, with new episodes every Wednesday. |

Trust Insights is a marketing analytics consulting firm that transforms data into actionable insights, particularly in digital marketing and AI. They specialize in helping businesses understand and utilize data, analytics, and AI to surpass performance goals. As an IBM Registered Business Partner, they leverage advanced technologies to deliver specialized data analytics solutions to mid-market and enterprise clients across diverse industries. Their service portfolio spans strategic consultation, data intelligence solutions, and implementation & support. Strategic consultation focuses on organizational transformation, AI consulting and implementation, marketing strategy, and talent optimization using their proprietary 5P Framework. Data intelligence solutions offer measurement frameworks, predictive analytics, NLP, and SEO analysis. Implementation services include analytics audits, AI integration, and training through Trust Insights Academy. Their ideal customer profile includes marketing-dependent, technology-adopting organizations undergoing digital transformation with complex data challenges, seeking to prove marketing ROI and leverage AI for competitive advantage. Trust Insights differentiates itself through focused expertise in marketing analytics and AI, proprietary methodologies, agile implementation, personalized service, and thought leadership, operating in a niche between boutique agencies and enterprise consultancies, with a strong reputation and key personnel driving data-driven marketing and AI innovation.

Any idea what triggered the May 29 spike for Discord?