The wheels of time grind onward as the days shorten and we look to the back half of the year. Nothing heralds marketing’s busiest time like the dawn of that first major fall trend, pumpkin spice season. Nothing says pumpkin spice like some pumpkin spice-flavored data analysis. Let’s dig into the flavor of fall and see what’s new for 2022.

Pumpkin Spice Search Interest

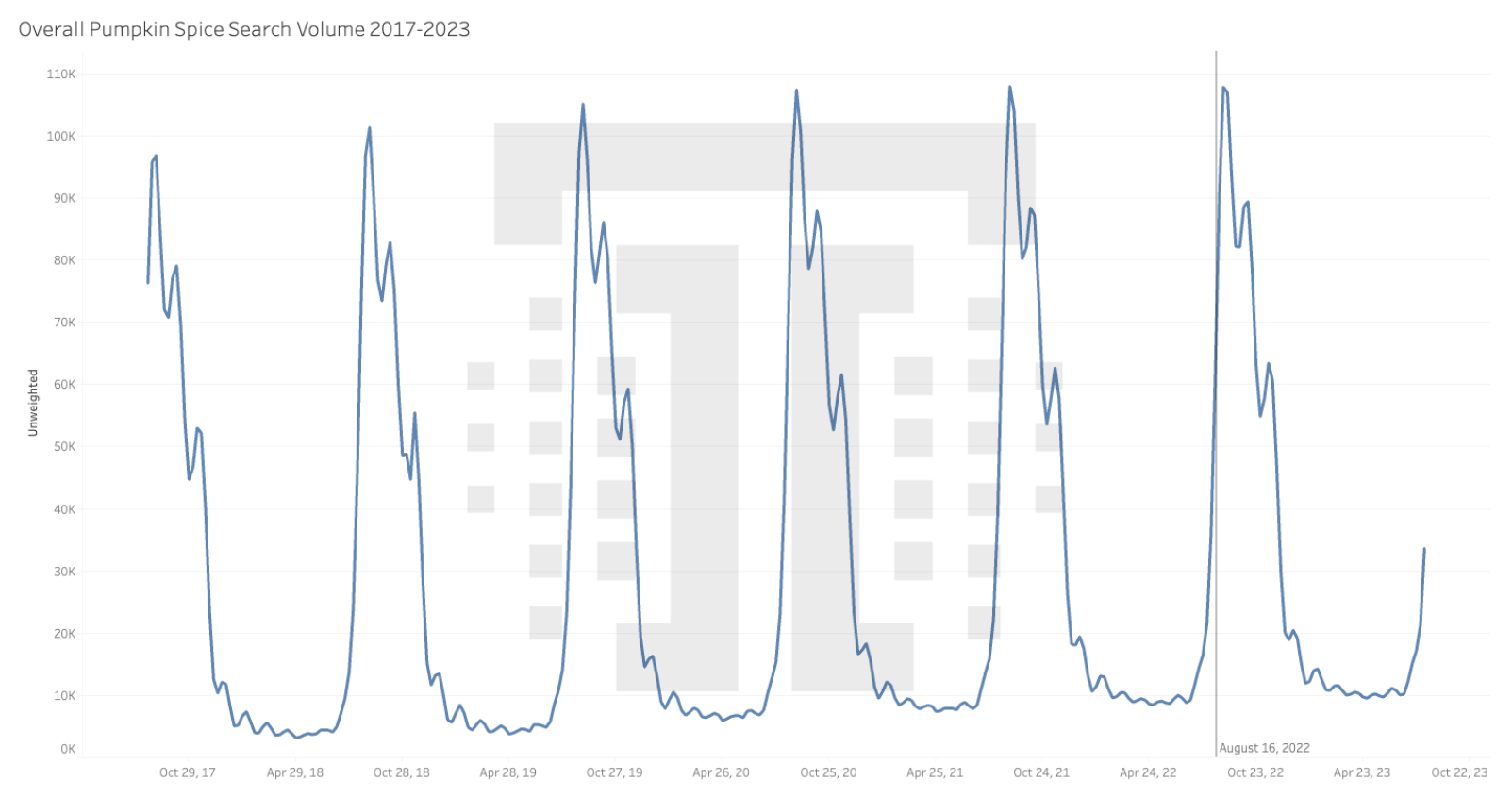

First, let’s look at the trend itself. Using a basket of search terms such as pumpkin spice, pumpkin spice latte, pumpkin spice recipe, etc. and Google Trends data bound to AHREFS data, let’s see when people are and will be searching for all things pumpkin spice:

The vertical grey line on the chart above is today, the date of publication. We see that in terms of the subject overall, this week and next are peak pumpkin spice interest. After this, interest diminishes somewhat through November, when it falls off totally after Thanksgiving.

Here’s something interesting, as it relates to predictive analytics and trends: the overall topic of pumpkin spice didn’t take a hit at all during the pandemic. One of the key points in predictive analytics is knowing when a major disruption such as a pandemic will affect your historical data and when it won’t; in the case of all things pumpkin spice search interest, there was no material impact.

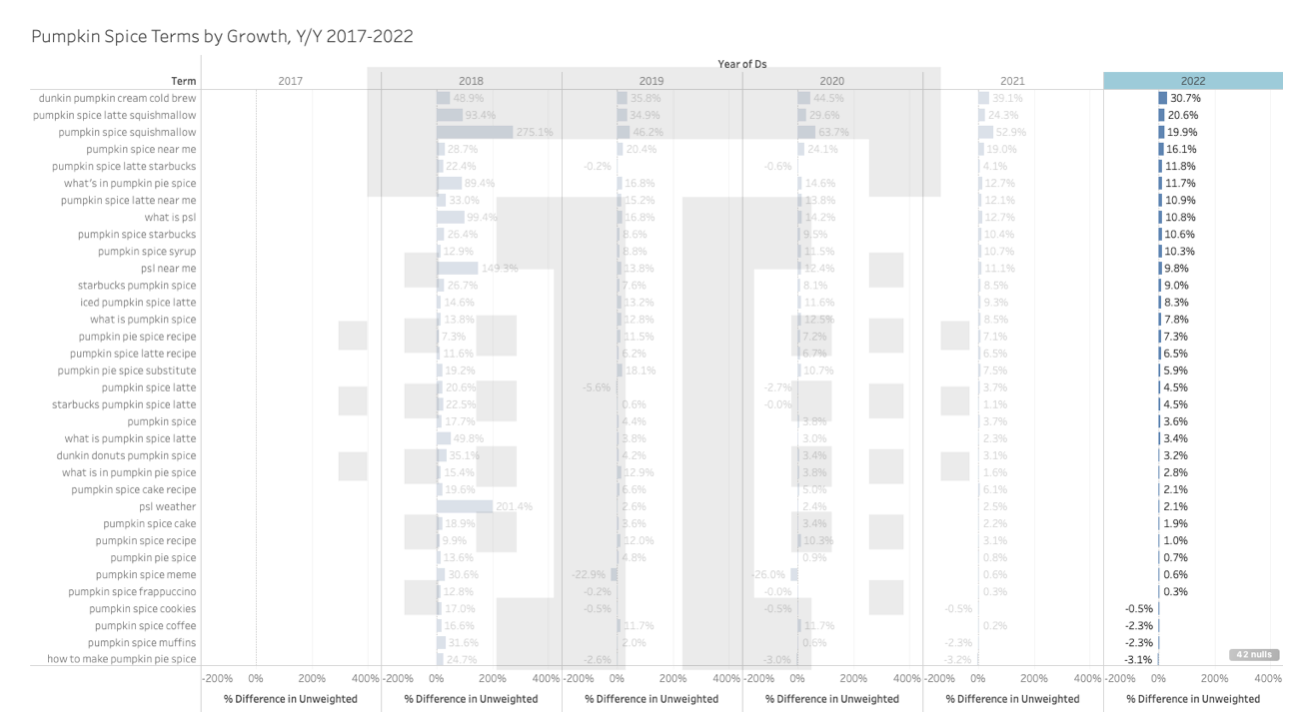

What’s of special interest is when we break down the year over year changes in individual search term volumes. This is where we find the hidden gems, the topics we could talk about if we wanted to showcase our knowledge of the domain to potential customers:

We see a 30.7% year over year increase in search interest about the Dunkin Pumpkin Cream Cold Brew beverage, followed by two terms we’ve not seen previously, the pumpkin spice squishmallow and the pumpkin spice latte squishmallow. For those unfamiliar (we had to look it up), squishmallows are a type of stuffed animal that’s filled with memory foam to give it a different texture and weight.

Of special note is that this item is totally sold out at retailers. That brings us to a second interesting phenomenon, one worth digging into.

Pumpkin Spice Conversation

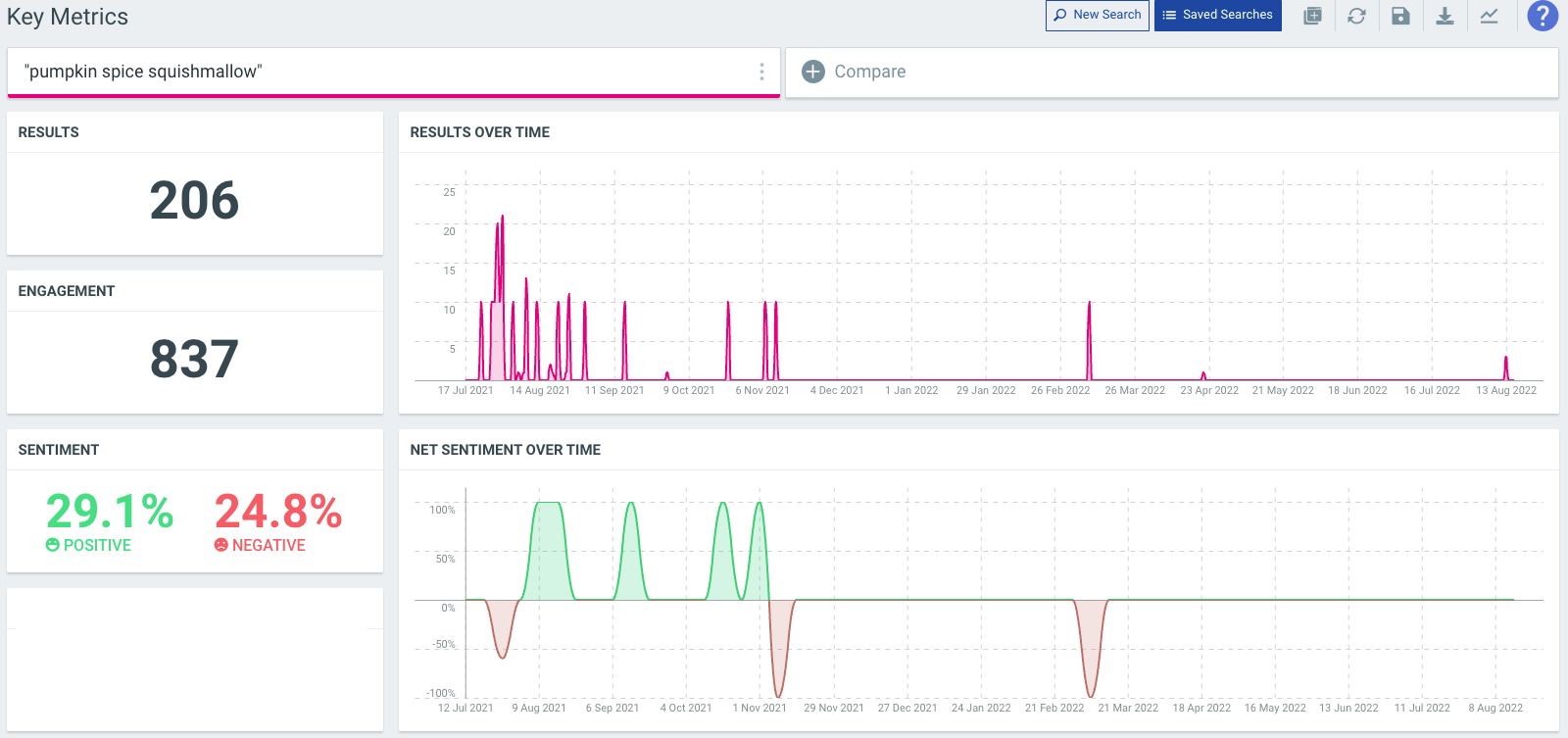

If we look at conversational volume in public social media spaces using Talkwalker’s monitoring service for the pumpkin spice squishmallow, we see this:

That’s it. Just 206 results with 836 engagements. That should provoke some cognitive dissonance in every digital marketer’s and social media marketer’s mind. How does a product have large increases in year over year search volume AND be totally sold out, yet have almost no conversational volume on public social media channels?

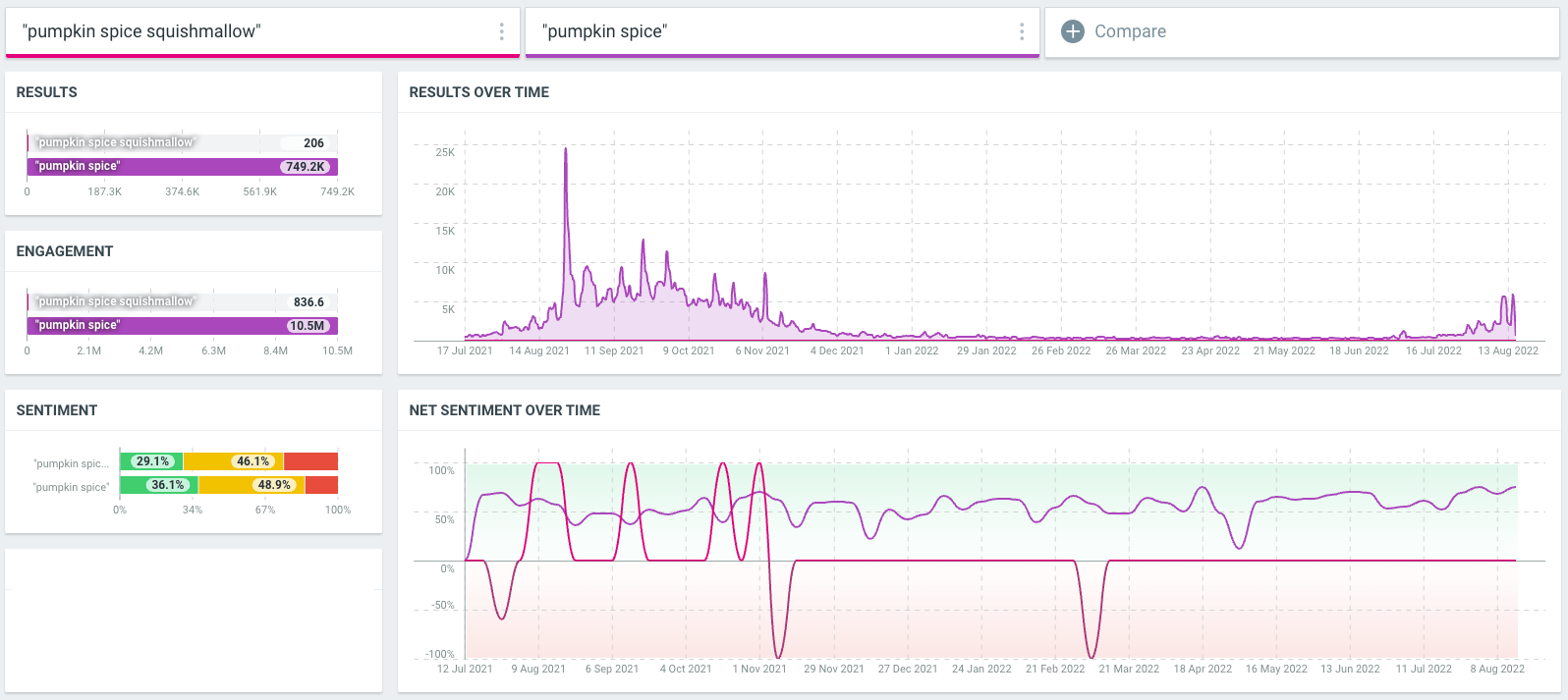

It’s not as though Talkwalker’s tool is ineffective. We see that it detects pumpkin spice as a general trend just fine:

749,000 results and 10.5 million engagements is a reasonable and sensible volume that matches the overall general search trend.

So what gives? How does a product remain in totally sold-out status, have very high search volume and interest, yet have no social media conversation on public social networks?

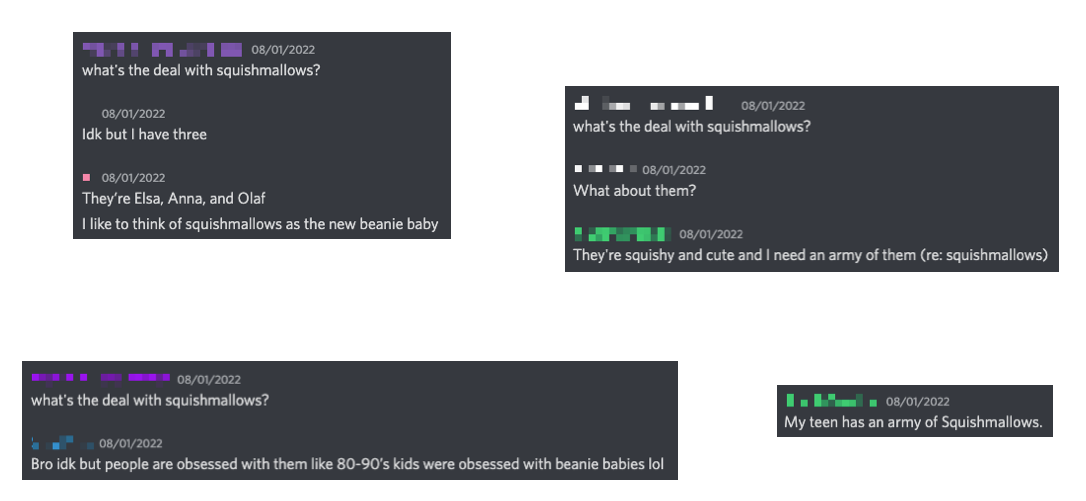

The answer is that the conversations about the product are happening elsewhere, in non-public places. I asked around in a few Discord servers I’m a member of:

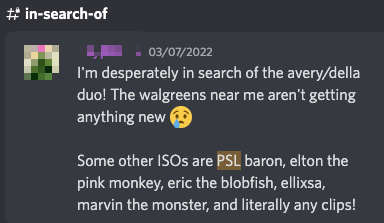

It’s a thing. So I joined several of the largest Squishmallow Discord servers – individual places with thousands and thousands of people talking about the topic, and I found the answer as to why Target is sold out.

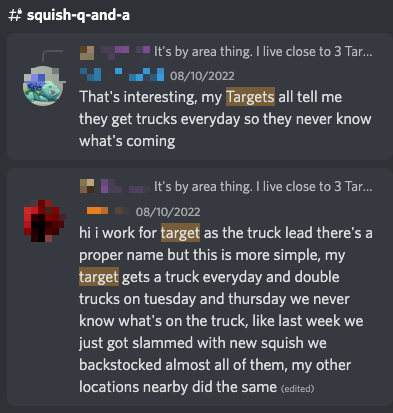

There’s a MASSIVE market of people buying, selling, and trading squishmallows – and the Target pumpkin spice squishmallow is a favorite, all year round. So much so that people even coordinate on when Target gets deliveries:

Think about that for a second. People so badly want your product or service that they are literally coordinating when to stop by your store to see if the product is in stock.

Why Do We Care About This Anyway?

As marketers, as content creators, and as business folks who want to keep our finger on the pulse of our audiences, we should know what’s happening and when. Here’s the catch: conversations about products and services are increasingly moving out of the public eye. Services like Telegram, Slack, and Discord are where people have conversations away from the prying eyes of marketers – and those conversations clearly drive real sales.

If I were a product marketing manager at Target, I’d be looking at my SKUs week over week to see what’s suddenly spiking, then hit up my social media team to see where conversations are happening. If tools that monitor public social media aren’t showing useful results or results that are disproportionally small to the end outcome, I know I need to be digging into private social media communities to find out more.

And if I were a really clever marketer at Target, I’d commission a specific landing page on the Target website where people to register and receive notifications about when their favorite squishmallows were in stock or coming to a store near them, then find the specific private communities where these conversations happen the most and ask if anyone would be interested in that service.

If I were a marketer at Dunkin or Starbucks? You bet I’d be asking my merch teams to commission a limited edition, branded pumpkin spice squishmallow to compete on the market and offer a collectible that would probably sell out the moment I announced it.

The key takeaway for all of us marketers is that we need to keep an eye on search volume to understand where our audiences are exhibiting interest, then look in private and public social media communities to understand what’s the underlying motivator of that search interest. With these two sources, we can better understand the voice of our customers and serve them exactly what they want – and generate massive results in the process.

|

Need help with your marketing AI and analytics? |

You might also enjoy:

|

|

Get unique data, analysis, and perspectives on analytics, insights, machine learning, marketing, and AI in the weekly Trust Insights newsletter, INBOX INSIGHTS. Subscribe now for free; new issues every Wednesday! |

Want to learn more about data, analytics, and insights? Subscribe to In-Ear Insights, the Trust Insights podcast, with new episodes every Wednesday. |

Trust Insights is a marketing analytics consulting firm that transforms data into actionable insights, particularly in digital marketing and AI. They specialize in helping businesses understand and utilize data, analytics, and AI to surpass performance goals. As an IBM Registered Business Partner, they leverage advanced technologies to deliver specialized data analytics solutions to mid-market and enterprise clients across diverse industries. Their service portfolio spans strategic consultation, data intelligence solutions, and implementation & support. Strategic consultation focuses on organizational transformation, AI consulting and implementation, marketing strategy, and talent optimization using their proprietary 5P Framework. Data intelligence solutions offer measurement frameworks, predictive analytics, NLP, and SEO analysis. Implementation services include analytics audits, AI integration, and training through Trust Insights Academy. Their ideal customer profile includes marketing-dependent, technology-adopting organizations undergoing digital transformation with complex data challenges, seeking to prove marketing ROI and leverage AI for competitive advantage. Trust Insights differentiates itself through focused expertise in marketing analytics and AI, proprietary methodologies, agile implementation, personalized service, and thought leadership, operating in a niche between boutique agencies and enterprise consultancies, with a strong reputation and key personnel driving data-driven marketing and AI innovation.

2 thoughts on “Pumpkin Spice Data Analytics, 2022 Edition”