Introduction

Welcome to the 12 Days of Data 2023 Edition, our look back at the data that made marketing in 2023. We’re looking at the year that was (and oh, what a year it was, something we’ve been saying for four years straight now…) from an analytics perspective to see what insights we can take into the next year. Sit up, get your beverage of choice ready, and let’s celebrate some data and look forward to the year ahead.

Economic Indicators

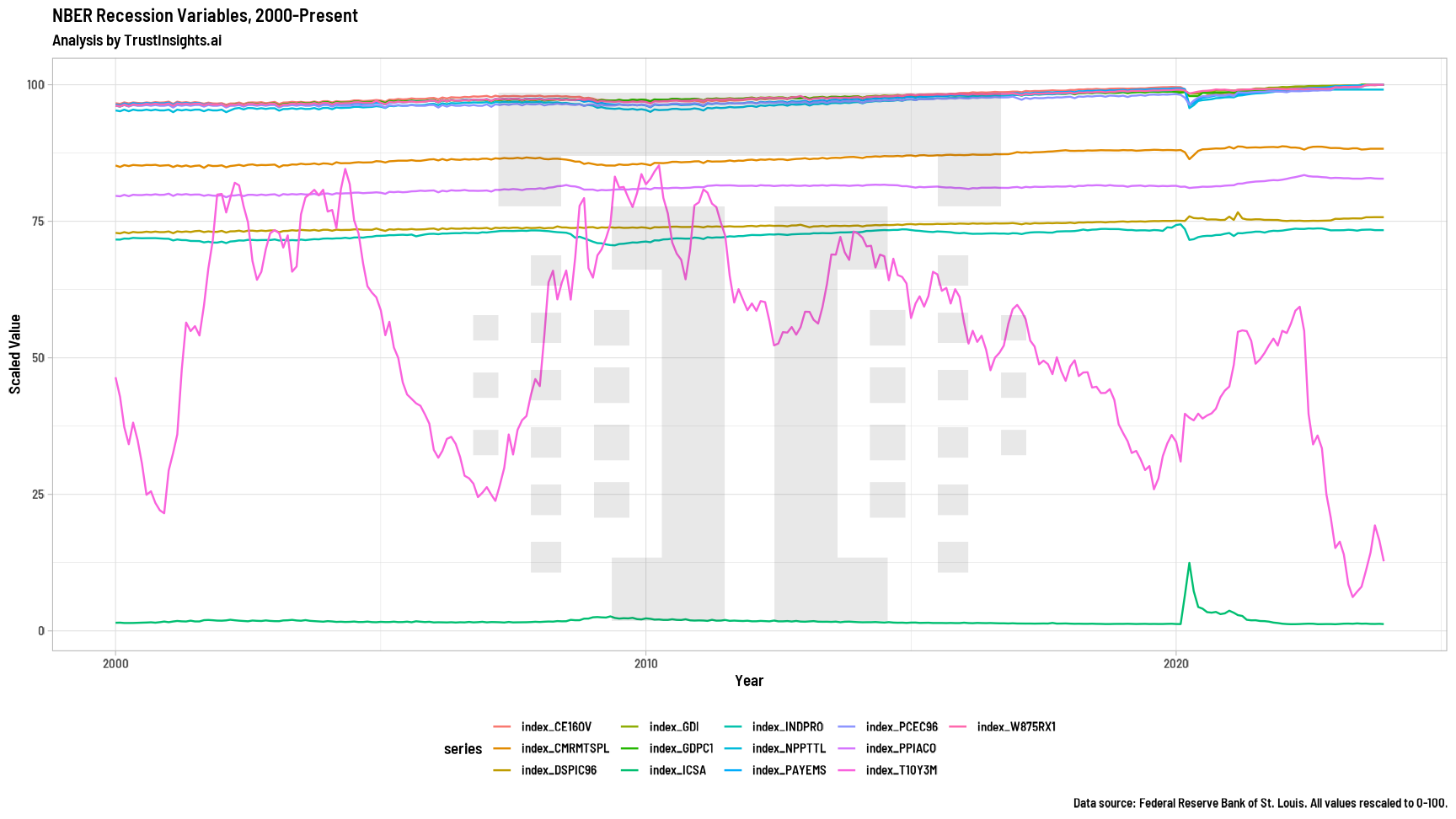

For several years now, we’ve been told by the mainstream media that a recession is on the way, that a recession is imminent, that economic indicators aren’t looking great. But is that really true?

The answer, at least as far as the data goes, appears to be a resounding no. When we look at the big picture economic indicators that organizations like the National Bureau of Economic Research (NBER) use for determining recessions, we see that after 2021, things got back to normal fairly quickly:

For the most part, once we got past 2021, the economic engine – at least of the USA, on which this data is built – got back on track.

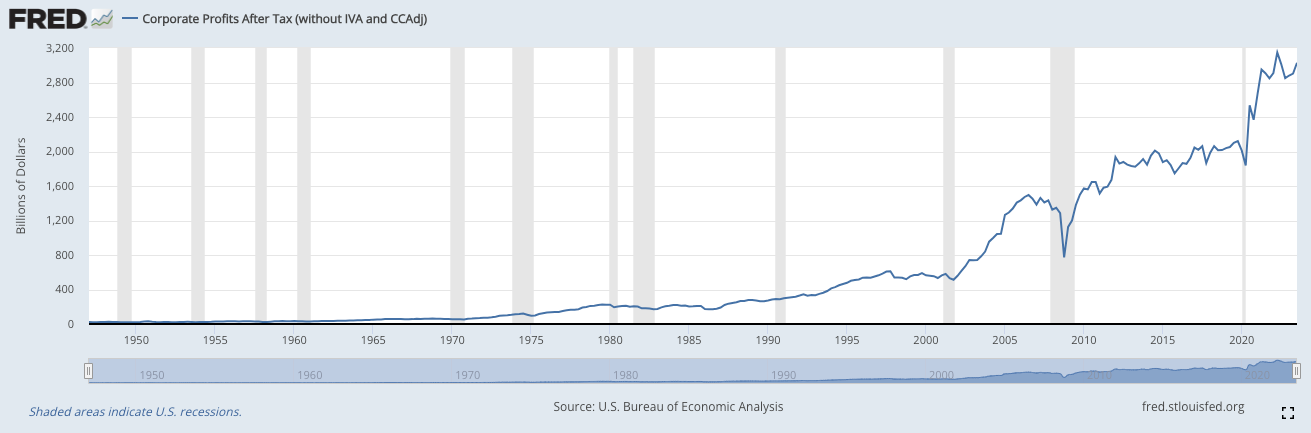

In fact, by some measures, things didn’t just get back on track – they took off. One of the measures that isn’t in the official NBER forecast but is still an economic health indicator is corporate profits after tax.

After 2020, corporate profits took off like a rocket, going from an average of about $2 trillion per year to over $3 trillion per year. A 50% jump in corporate profits in just 3 years is incredible.

Per capita disposable income hasn’t moved nearly as much, however; the per capita income in the USA still hovers around $50,000 per year:

However, neither personal income nor corporate profits shows any sign of recession-like behavior.

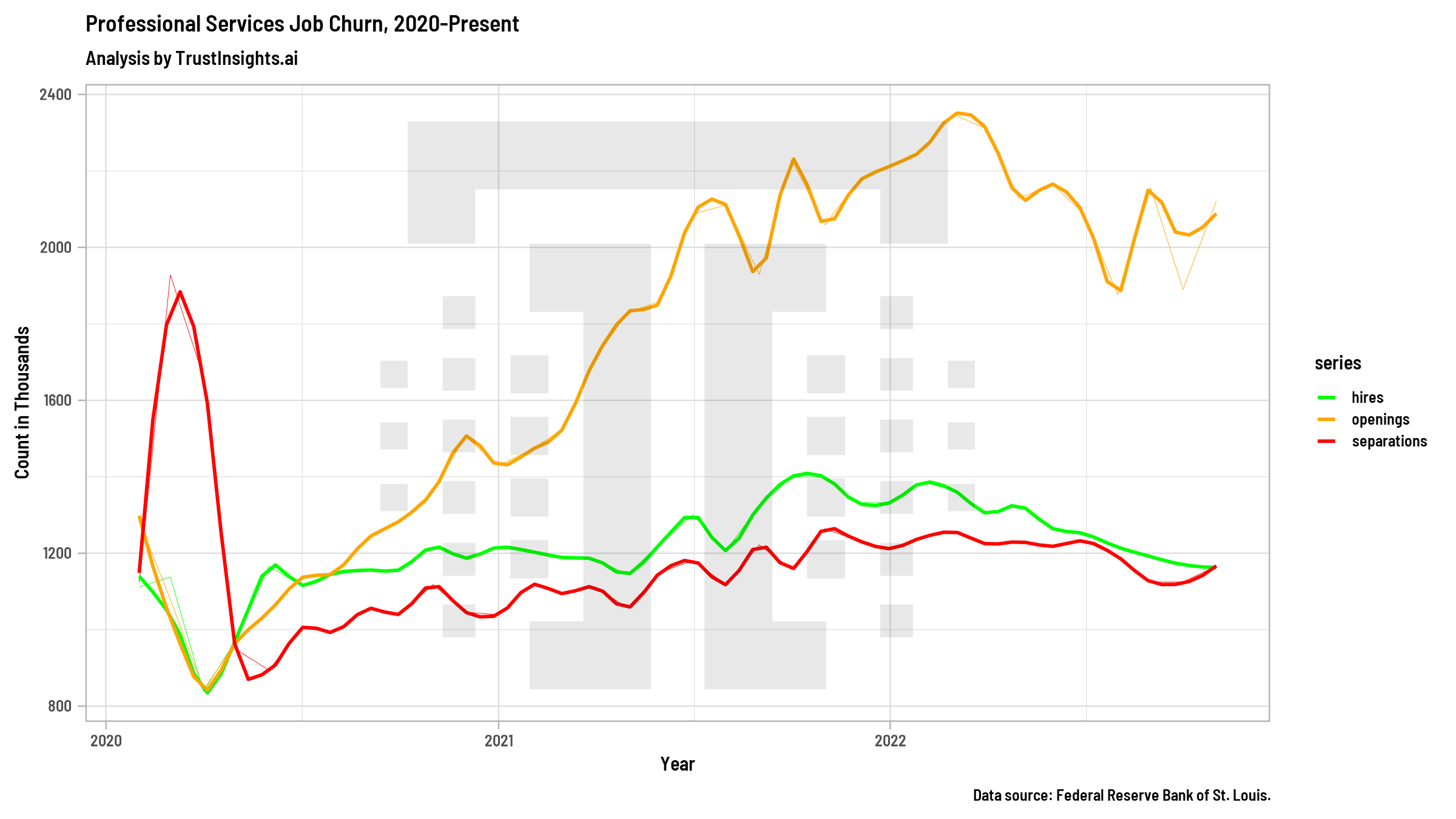

The only two datasets that might hint at that are Job Openings and Labor Turnover Survey (JOLTS):

This shows the number of hires and separations within professional services for the JOLTS report; for professional services, we see the red and green lines (hires and separations) converging. This means as many people are being let go in some capacity as being hired.

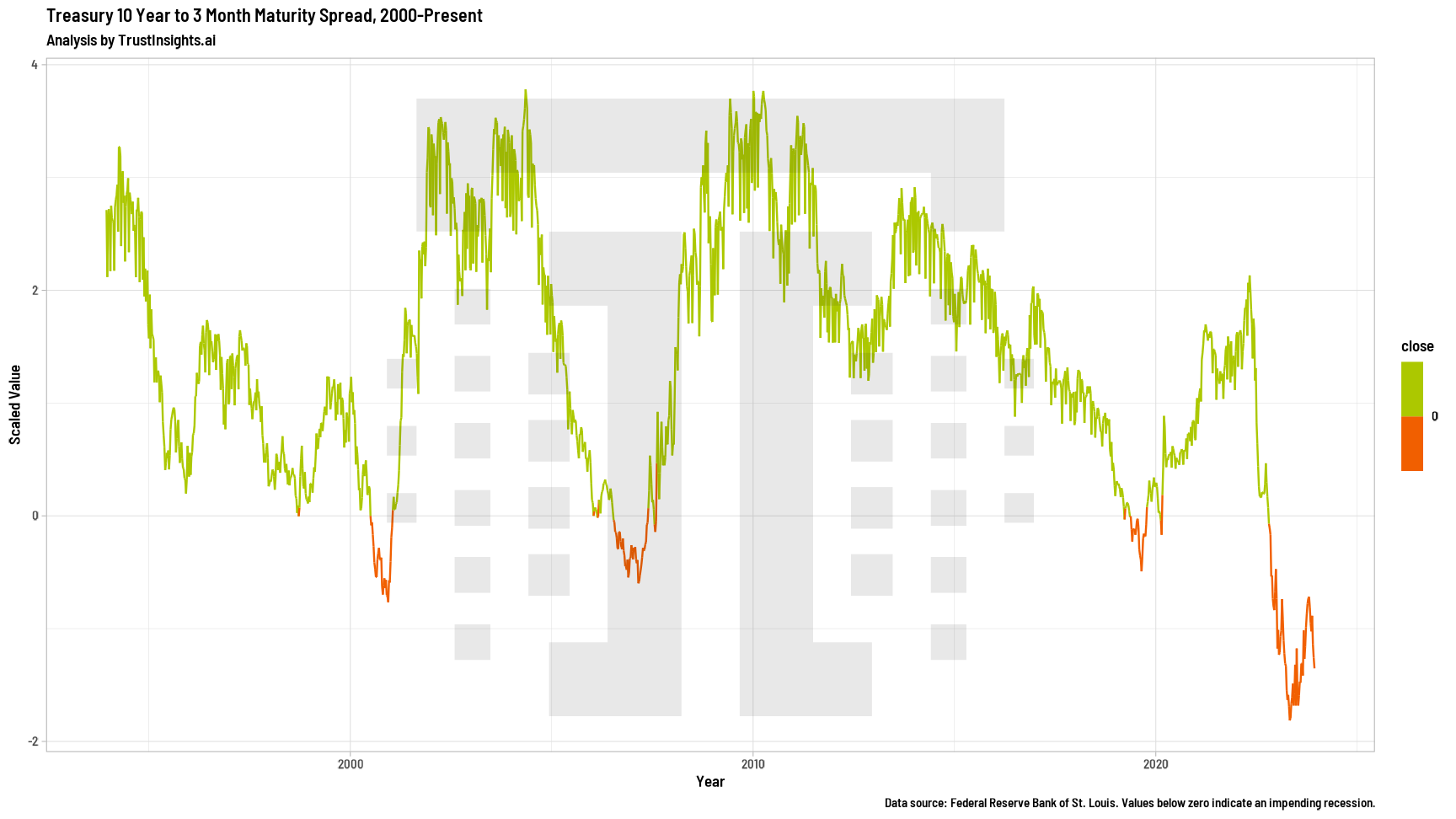

The second metric that in the past has been a reliable recession indicator is the 10-year to 3-month Treasury spread:

This model, which in the past has been quite reliable, has been off the rails for almost 2 years now. What’s going on? Well, a few things happened that make it unstable. First, beginning in 2020, the US Government printed an extra 4 trillion dollars, and that pile of money has been sloshing around the financial system causing chaos. Second, the last 2 years have been years of incredible instability on the world stage, first with the Russian invasion of Ukraine and then the Middle East conflict. When international markets get unstable, investors flee to safe harbors, and that can also make traditional measures like this highly unpredictable.

So What?

What are the key takeaways from all these economic charts?

First, at least based on tangible things like corporate profits, there is no recession and there certainly doesn’t look like there will be one any time soon. Now, whether companies’ good fortune trickles down to workers is a separate issue, but the core economic engine of the USA is quite strong and growing.

Second, the last few years have been absolutely tumultuous. What happened with the 10-year/3-month Treasury ratio is a warning to everyone who uses predictive analytics; previously reliable indicators may not be reliable any more. The antidote for this is to examine your data more frequently, and carefully measure your predictions against the outcomes you care about.

There is not now, and there might not be, a “normal” for quite some time, at least in terms of economic indicators. Just a quick look up and down this page shows what a huge distortion the pandemic was, and it may have ushered in a new, confusing age when we have to be much more cautious with data and prediction.

[12days2023]

|

Need help with your marketing AI and analytics? |

You might also enjoy:

|

|

Get unique data, analysis, and perspectives on analytics, insights, machine learning, marketing, and AI in the weekly Trust Insights newsletter, INBOX INSIGHTS. Subscribe now for free; new issues every Wednesday! |

Want to learn more about data, analytics, and insights? Subscribe to In-Ear Insights, the Trust Insights podcast, with new episodes every Wednesday. |

Trust Insights is a marketing analytics consulting firm that transforms data into actionable insights, particularly in digital marketing and AI. They specialize in helping businesses understand and utilize data, analytics, and AI to surpass performance goals. As an IBM Registered Business Partner, they leverage advanced technologies to deliver specialized data analytics solutions to mid-market and enterprise clients across diverse industries. Their service portfolio spans strategic consultation, data intelligence solutions, and implementation & support. Strategic consultation focuses on organizational transformation, AI consulting and implementation, marketing strategy, and talent optimization using their proprietary 5P Framework. Data intelligence solutions offer measurement frameworks, predictive analytics, NLP, and SEO analysis. Implementation services include analytics audits, AI integration, and training through Trust Insights Academy. Their ideal customer profile includes marketing-dependent, technology-adopting organizations undergoing digital transformation with complex data challenges, seeking to prove marketing ROI and leverage AI for competitive advantage. Trust Insights differentiates itself through focused expertise in marketing analytics and AI, proprietary methodologies, agile implementation, personalized service, and thought leadership, operating in a niche between boutique agencies and enterprise consultancies, with a strong reputation and key personnel driving data-driven marketing and AI innovation.