This data was originally featured in the October 2nd, 2024 newsletter found here: INBOX INSIGHTS, October 2, 2024: Getting Lost in AI, Economic Indicators Part 1

In this week’s Data Diaries, let’s do a quick review of economic indicators and what they mean. With as many unprecedented things happening pretty much all the time now – thousand-year floods, Category 4 storms forming in 2 days, labor strikes, wars, etc. – more than ever we need to be keeping our finger on the pulse of what’s going on so we can react quickly and plan accordingly.

Fundamentally, there are two classes of economic indicator – leading and lagging. Leading indicators tend to be used to predict things, and lagging indicators tend to be used to measure outcomes.

Some examples of leading indicators:

- Building permits: whatever’s going to be built doesn’t exist yet, but this is a good indicator that something’s probably going to be built.

- Hours worked: when people work, they earn wages that get spent. More hours being worked means more compensation, as well as rising activity.

- Consumer confidence: when people feel good about the economy, they tend to spend more.

Some examples of lagging indicators:

- Consumer price index: how much more or less things cost, which is well after something has been made, shipped, and put up for sale.

- Unemployment rate: how many people are looking for work. This lags because it takes time for people to file unemployment.

- Inventory levels: how much of something a company has left after people have done their buying.

When I look at economic indicators, I try to look at a mix of leading and lagging, especially for indicators which can be both. Unemployment is a lagging indicator of company demand (you lay off people when you no longer have the revenue or profits to support their work, or their work has been outsourced), but is also a leading indicator of purchasing (unemployed people tend to buy less stuff).

Selecting economic indicators is something you should do with an eye towards your business. If you look at your current customers and your value chain, what companies, industries, and components are critical? If you’re a restaurant, the price of beef or rice or flour is a leading indicator because that’s going to affect what it costs to make your products. The price of gold is probably not as relevant.

If you’re a consulting firm like Trust Insights, hiring demand for marketing jobs is supremely relevant, because the less demand there is, the more people on the job market, and the fewer potential buyers there are of our products and services.

So how do you decide what economic indicators to use? Unsurprisingly, one way to assemble a basket of economic indicators would be to ask an Internet-aware generative AI model like ChatGPT with web search enabled, Perplexity, or Google Gemini (the consumer edition). We specifically want to ask about economic indicators available through a free, public source like the St. Louis Federal Reserve Bank’s FRED.

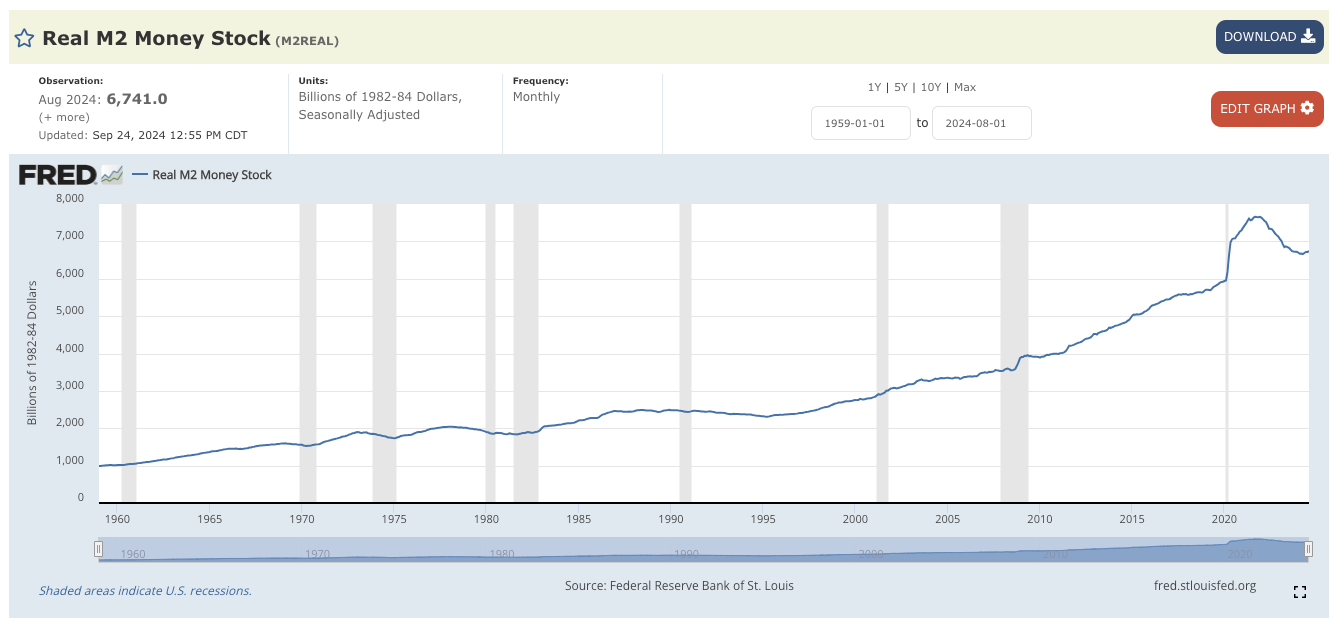

Here’s an example of the kinds of data FRED provides:

In this example, we’re looking at M2, the amount of money available in the US economy created by the US government. What it tells us is that in 2020, in the early months of the pandemic, the US government created an extra trillion dollars, and then did so again in 2021. This had a massive inflationary effect that is still being felt today. Since 2021, the government has been trying to slowly destroy that extra money to reduce inflation without causing massive economic chaos.

If your business dealt with any kind of financing and lending, this economic indicator would be a strong leading indicator to help you understand how borrowing was likely to go.

In next week’s issue, we’ll look at building a complex prompt to gather up the data, and the week after that, we’ll look at how to start analyzing it. Stay tuned!

|

Need help with your marketing AI and analytics? |

You might also enjoy:

|

|

Get unique data, analysis, and perspectives on analytics, insights, machine learning, marketing, and AI in the weekly Trust Insights newsletter, INBOX INSIGHTS. Subscribe now for free; new issues every Wednesday! |

Want to learn more about data, analytics, and insights? Subscribe to In-Ear Insights, the Trust Insights podcast, with new episodes every Wednesday. |

Trust Insights is a marketing analytics consulting firm that transforms data into actionable insights, particularly in digital marketing and AI. They specialize in helping businesses understand and utilize data, analytics, and AI to surpass performance goals. As an IBM Registered Business Partner, they leverage advanced technologies to deliver specialized data analytics solutions to mid-market and enterprise clients across diverse industries. Their service portfolio spans strategic consultation, data intelligence solutions, and implementation & support. Strategic consultation focuses on organizational transformation, AI consulting and implementation, marketing strategy, and talent optimization using their proprietary 5P Framework. Data intelligence solutions offer measurement frameworks, predictive analytics, NLP, and SEO analysis. Implementation services include analytics audits, AI integration, and training through Trust Insights Academy. Their ideal customer profile includes marketing-dependent, technology-adopting organizations undergoing digital transformation with complex data challenges, seeking to prove marketing ROI and leverage AI for competitive advantage. Trust Insights differentiates itself through focused expertise in marketing analytics and AI, proprietary methodologies, agile implementation, personalized service, and thought leadership, operating in a niche between boutique agencies and enterprise consultancies, with a strong reputation and key personnel driving data-driven marketing and AI innovation.