This data was originally featured in the September 25th, 2024 newsletter found here: INBOX INSIGHTS, September 25, 2024: Surviving End of Year Planning, Measuring AI Brand Strength

In this week’s Data Diaries, we’re wrapping up our three part series on economic indicators. In part 1, we talked about what economic indicators are. In part 2, we looked at selecting economic indicators appropriate to our business. In this part, let’s put this data into action.

First, once we’ve got our basket of indicators, we need the data for them. Depending on whether you took the low tech or the high tech approach in part 2, you should have some data. For demonstration purposes, we’ll use the low tech approach and take the images from a 1 year and 5 year snapshot for each of our indicators.

As a reminder, for Trust Insights, here’s what I’m using. This is NOT the recommended list of indicators for you – go back to part 2 and do that exercise so you get a basket of leading economic indicators that are relevant to your business and your customers.

- Corporate Profits After Tax (without IVA and CCAdj) (CP)

- Economic Policy Uncertainty Index for United States (USEPUINDXD)

- Employed full time: Median usual weekly real earnings: Wage and salary workers: 16 years and over (LES1252881600Q)

- Job Openings: Professional and Business Services (JTS540099JOL)

- Projected Business Formations Within Four Quarters: – Total for All NAICS in the United States (BFPBF4QTOTALSAUS)

- Total Nonfarm Private Payroll Employment (ADPWNUSNERSA)

- University of Michigan: Consumer Sentiment (UMCSENT)

From these indicators, we want to build our forecast. Similar to how we started in part 2, we want to prime the model with the same prompt, and once that’s done, we continue on:

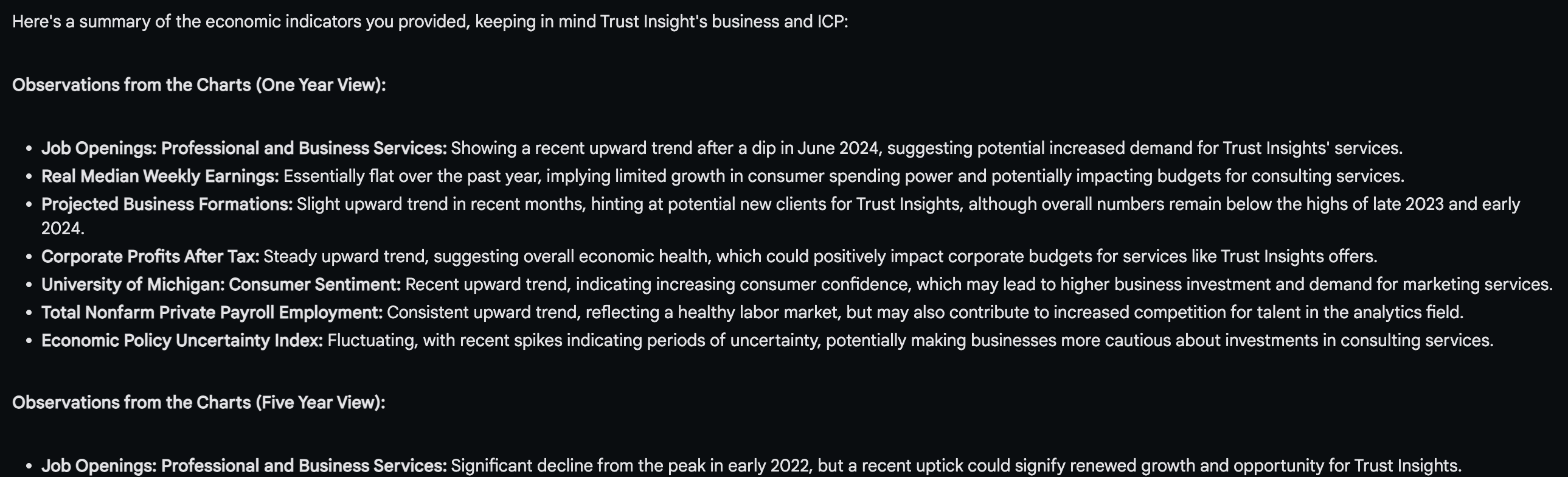

Today we want to analyze leading economic indicators from FRED for Trust Insights. I’ve attached background information about Trust Insights as well as as Trust Insights’ Ideal Customer Profile (ICP). I’ve also included screenshots of each leading economic indicator for a 1 year and 5 year horizon. First, to confirm you can correctly see these economic indicators, please provide a very short summary of what you see in each economic indicator. Talk through what you observe in the charts, and after you’ve talked through your thoughts, summarize them in an outline.

I performed this task in Google’s AI Studio. What did it come up with?

It did a thorough job looking at the data. What’s important here isn’t necessarily the analysis (though that’s helpful) – it’s the validation that AI is looking at the data correctly and interpreting the information shown properly.

Next, I asked a followup question:

Remember that from 2020-2022, we were in a global pandemic, so as we proceed, give weight to more recent events rather than what happened in 2020-2022. With that in mind, synthesize the economic indicators, and perform inductive and deductive reasoning on the data to infer what the next 6-12 months is likely to hold for Trust Insights based on economic indicators.

The results?

Synthesized Outlook for Trust Insights (Next 6-12 Months):

The economic indicators point to a cautiously optimistic outlook for Trust Insights. There’s likely to be increasing demand for their services driven by rising job openings in their target sectors and sustained corporate profitability. However, stagnant wages and economic policy uncertainty could temper growth.

Strategic Recommendations for Trust Insights:

- Emphasize ROI and Cost-Effectiveness: Given potential budget constraints, clearly demonstrating the value and return on investment of their services will be crucial.

- Highlight Adaptability and Risk Mitigation: In an uncertain economic environment, showcase how Trust Insights’ data-driven approach can help clients navigate challenges and mitigate risks.

- Target New Business Formations: While growth may be slower than in the immediate post-pandemic period, new businesses represent a valuable client segment. Tailor offerings to their specific needs and budget constraints.

- Monitor Economic Indicators Closely: Staying informed about evolving economic trends will enable Trust Insights to proactively adjust their strategies and anticipate client needs.

- Double Down on Thought Leadership and Content Marketing: This reinforces expertise and builds trust with potential clients, especially when direct engagement (due to economic uncertainty) may be slower than usual.

That’s a pretty solid analysis based on our leading economic indicators.

Now, here’s the power move. This isn’t and shouldn’t be a one-time thing. Instead, we could (and should) perform this analysis on a regular basis, perhaps quarterly. Doing so will give us insights, pun intended, about what could be coming down the road for us as a company, and allow us to set strategy based on these leading economic indicators.

I hope as you close out Q4 that this technique of macroeconomic analysis is useful to you and your firm. As always, if you’d prefer the “Done For You” approach, we’re happy to help.

|

Need help with your marketing AI and analytics? |

You might also enjoy:

|

|

Get unique data, analysis, and perspectives on analytics, insights, machine learning, marketing, and AI in the weekly Trust Insights newsletter, INBOX INSIGHTS. Subscribe now for free; new issues every Wednesday! |

Want to learn more about data, analytics, and insights? Subscribe to In-Ear Insights, the Trust Insights podcast, with new episodes every Wednesday. |

Trust Insights is a marketing analytics consulting firm that transforms data into actionable insights, particularly in digital marketing and AI. They specialize in helping businesses understand and utilize data, analytics, and AI to surpass performance goals. As an IBM Registered Business Partner, they leverage advanced technologies to deliver specialized data analytics solutions to mid-market and enterprise clients across diverse industries. Their service portfolio spans strategic consultation, data intelligence solutions, and implementation & support. Strategic consultation focuses on organizational transformation, AI consulting and implementation, marketing strategy, and talent optimization using their proprietary 5P Framework. Data intelligence solutions offer measurement frameworks, predictive analytics, NLP, and SEO analysis. Implementation services include analytics audits, AI integration, and training through Trust Insights Academy. Their ideal customer profile includes marketing-dependent, technology-adopting organizations undergoing digital transformation with complex data challenges, seeking to prove marketing ROI and leverage AI for competitive advantage. Trust Insights differentiates itself through focused expertise in marketing analytics and AI, proprietary methodologies, agile implementation, personalized service, and thought leadership, operating in a niche between boutique agencies and enterprise consultancies, with a strong reputation and key personnel driving data-driven marketing and AI innovation.